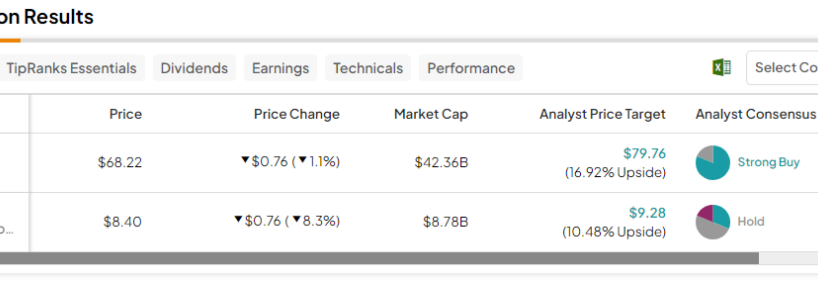

In this piece, I evaluated two fintech stocks, Block (NYSE:SQ) and SoFi Technologies (NASDAQ:SOFI), using TipRanks’ comparison tool to see which is better. A closer look suggests a neutral view for Block and a bullish view for SoFi.

Previously known as Square, Block provides payment-processing solutions for credit cards, including point-of-sale software and hardware. Meanwhile, SoFi Technologies offers lending and financial services products, including home, student, and personal loans. It also provides related technology products and solutions.

Shares of Block are down 11% year-to-date, although they’re up 71% over the last three months. Despite that recent rally, the stock is off 16% over the last year. Meanwhile, SoFi shares are down 8% year-to-date after Monday’s 20% pop but are up 21% over the last three months, bringing their one-year return to 32%.

Block (NYSE:SQ)

While Block was profitable in 2021, it took a bit of a detour by diverting significant attention away from its healthy and growing payment processing businesses and toward blockchain and Bitcoin (BTC-USD), even changing its name to reflect that diversion. As such, Block looks like a bit of a wait-and-see story, so a neutral view seems appropriate.

Unfortunately, Block’s Bitcoin diversion is triggering extreme movements in its financial results, which is a tough pill for many investors to swallow. For example, the company’s CashApp revenue rose 34% year-over-year in the third quarter, but it was up only 26% when excluding Bitcoin trading.

More importantly, there’s been significant insider selling in Block shares recently. Although TipRanks shows Informative Buy transactions of $26.5 million over the last three months, all of that is from a single transaction three months ago. More recently, we’ve begun to see insiders sell off some shares, although those sales just haven’t been enough to offset that sizable $26.5 million non-open-market purchase three months ago.

Story continues

These were Auto Sell transactions, which aren’t included in the Informative Sells total. Insiders often…

..