(Bloomberg) — Just as worries from the fallout of Russia’s invasion of Ukraine and surging Covid cases pummel Chinese stocks, a local hedge fund that jumped almost 30 times over the past five years by picking undervalued shares is ready to dive in.

Most Read from Bloomberg

Guangdong Zhengyuan Private Fund Investment Management Co., which saw its assets surge fivefold from the start of last year to about 14 billion yuan ($2.2 billion) now, is planning to raise money again next month as stock valuations become increasingly attractive, founder and fund manager Liao Maolin said.

“With the market having fallen to this level, there are so many stocks that I want to buy now but we have no more money” as the company is already fully invested, he said in a March 8 phone interview from Guangzhou, where the company is based.

While that sounds like a risky bet, Liao has built a solid track record after his funds returned a whopping 2,944% since 2017, topping five-year rankings for stock hedge funds at Shenzhen PaiPaiWang Investment & Management Co.

His rationale is simple: all the gloom out there — from the war in Ukraine to monetary tightening in the U.S. and economic headwinds at home — reinforces the possibility that policy makers will refrain from pricking more bubbles and move faster to spur encouraged areas like new infrastructure and digital transformation.

“Everything you see this year could be bad news and uncertainty, but the government will likely take counter-cyclical measures,” Liao, 37, said. “The negative news you see has been mostly priced in and we would instead see more unexpected policy support down the road.”

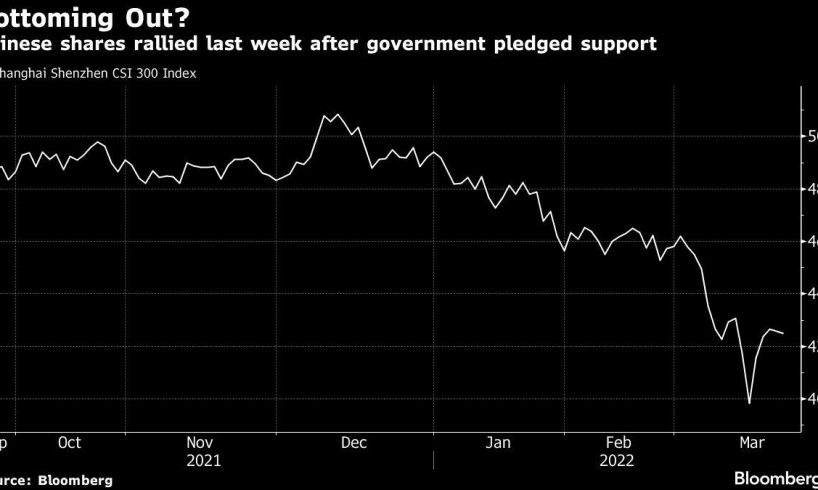

His comments were borne out last week, when Beijing pledged to stabilize markets, a move that triggered the biggest two-day rally in Chinese stocks since 1998. Policy makers are now expected to loosen monetary policy and ease up on technology and property industry crackdowns.

Story continues

Liao favors middle- and downstream firms in emerging strategic industries like batteries and new-energy vehicle parts, he said, declining to name…

..