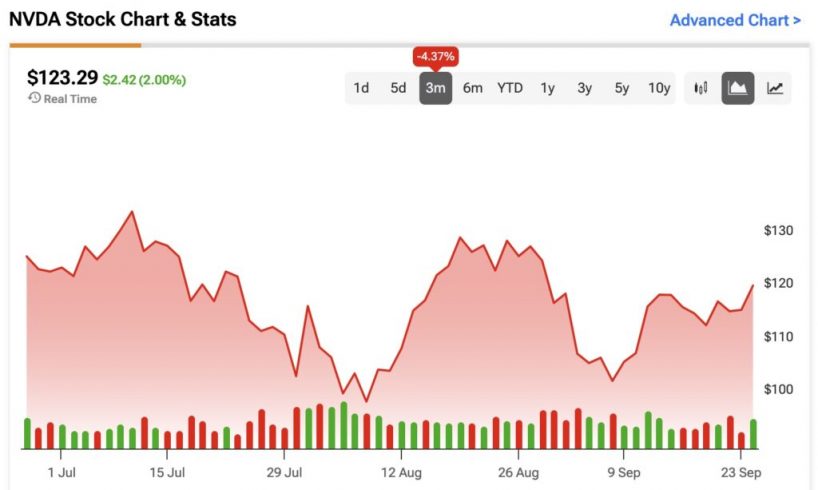

Nvidia’s (NVDA) ultra-bullish trend in the first half of the year has paused, with the stock failing to reach new peaks over the past few months. Following the highly anticipated Q2 earnings report at the end of August, Nvidia stock experienced a pullback due to elevated investor expectations for hypergrowth, despite the strong results it posted. I believe this price correction offers a compelling opportunity. In this article, I will outline five reasons for my bullish view on Nvidia, focusing on strong revenue growth (despite tough comps), AI dominance, valuation, technical indicators, and Wall Street analyst consensus.

Let’s dive in.

1. Nvidia’s Strong Revenue Growth Despite Tough Comparisons

The first point supporting a prolonged bullish thesis for Nvidia is the solid revenue growth demonstrated in its Q2 results, despite challenging comparisons.

Nvidia posted 122% year-over-year growth in the most recent quarter, reaching revenues of $30 billion—a remarkable achievement given the company’s already substantial revenue base. Although this growth rate is lower than the 200% surge from the previous quarter, the absolute triple-digit top-line growth remains impressive. This underscores Nvidia’s ability to scale its revenue significantly even when set against it’s prior performance.

While the post-Q2 stock pullback can be attributed to expectations being set too high, it’s crucial to note that Nvidia continues to deliver sequential quarterly revenue growth, signaling robust demand for its products, especially in AI and data centers. This level of sustained growth at such a large scale highlights Nvidia’s capacity to capture market share and drive long-term revenue expansion. Nvidia’s Q3 sales guidance of $32.5 billion further reflects the company’s confidence in maintaining its growth trajectory.

2. Nvidia’s Dominance in AI and Data Center Market

The second bullish point is Nvidia’s continued dominance in the data center GPU space, where it holds a 98% market share in this rapidly growing sector, according to HPCwire.

Demand for AI-driven…

..