NextEra Energy (NYSE: NEE) has a dividend yield of around 2.7% today. Income investors and those with a value bias probably won’t want to buy its shares, but if you like dividend growth stocks, the 10% annualized payout growth NextEra Energy has achieved over the past decade will probably get your juices flowing.

And if management is right, the future looks just as good as the past for dividend growth.

Why some people won’t like NextEra Energy

NextEra Energy has one major problem: Wall Street knows that this is a very well-run utility. That’s why the yield is 2.7%, which is below the 3% average for the utility sector, using the Vanguard Utilities Index ETF (NYSEMKT: VPU) as a proxy.

Sure, NextEra yields more than the 1.3% you would get from an S&P 500 Index fund, but it just isn’t a high yield stock. Dividend investors and those with a value bias — noting that the yield is at best middle of the road over the past decade — will probably want to look at utilities with higher yields.

Image source: Getty Images.

That said, the current dividend yield isn’t the reason to buy NextEra Energy. Dividend growth is the real story, with the dividend increasing by more than 180% over the past 10 years.

The stock has risen by almost the exact same amount over that span, as well, leading to a pretty impressive total return of more than 260%, with dividend reinvestment. That’s better than the S&P 500 index, which had a total return of around 225% over the same span. Step back for a second: NextEra, a utility company, beat the S&P 500!

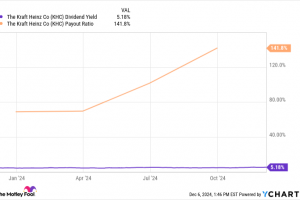

NEE Chart

But there’s another figure that you might find interesting: yield on purchase price. If you bought NextEra Energy in 2013 at its most expensive point, you would have paid $22.4375 per share, adjusted for a 4-for-1 stock split in 2020. The annualized dividend in the fourth quarter of 2013 was $0.66 per share, for a yield on purchase of roughly 2.9%.

At the end of the second quarter of 2024, the annualized dividend was $2.06 per share, which would mean your yield based on purchase price rose to a huge 9.2% or so in a little over a decade. If you…

..