(Bloomberg) — Asian stocks gained while the dollar softened amid bets that the Federal Reserve will cut interest rates this year, with US inflation data due this week likely to signal easing price pressure.

Most Read from Bloomberg

Stock markets in Hong Kong, China, Australia, South Korea and Japan climbed on Monday, while US equity futures were little changed. The Australian dollar, the euro and the yen strengthened versus the dollar, with Bank of Japan Deputy Governor Shinichi Uchida saying the end of the battle with deflation was in sight.

Global investors are hopeful that the Fed, along with the European Central Bank and its peers, will reduce interest rates this year. This, along with strong company earnings and signals from US officials that further rate hikes are unlikely, has boosted investor sentiment.

While economists are now expecting fewer Fed cuts than they did previously, “the markets have said – doesn’t matter – we’ve got stronger profit numbers,” Shane Oliver of AMP Capital Markets Ltd. told Bloomberg Television an interview. “That’s kept markets going.”

A swath of inflation prints from Australia to Japan, the Eurozone and the US is due this week as traders finesse bets on the outlook for monetary policy.

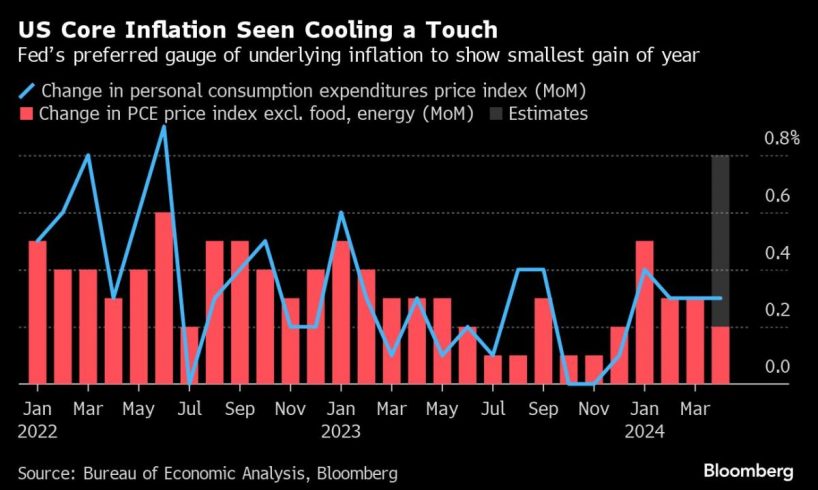

The ECB is widely expected to cut rates for the first time since concluding an unprecedented tightening campaign at its June meeting. But US officials are progressing toward a pivot at a slower pace, with Fed Chair Jerome Powell stressing the need for more evidence that inflation is on a sustained path to their 2% goal before cutting the policy benchmark.

Still, Wall Street got a degree of relief last week when University of Michigan figures showed consumers expect prices to climb less quickly than previously indicated.

“Risk sentiment is upbeat after softer inflation expectations” thanks to US data, said Charu Chanana of Saxo Capital Markets.

The Federal Reserve’s first-line inflation gauge — due on Friday — is set to show some modest relief from stubborn price pressures. John Williams, Lisa Cook, Neel Kashkari and Lorie Logan…

..