Selling an assortment of products that appeal to teens and preteens, Five Below (NASDAQ: FIVE) is a retail concept that’s gaining ground across the country. But you wouldn’t know that from investors’ reaction after the company reported full-year financial results for 2023. After the report dropped, Five Below stock itself dropped by 15%.

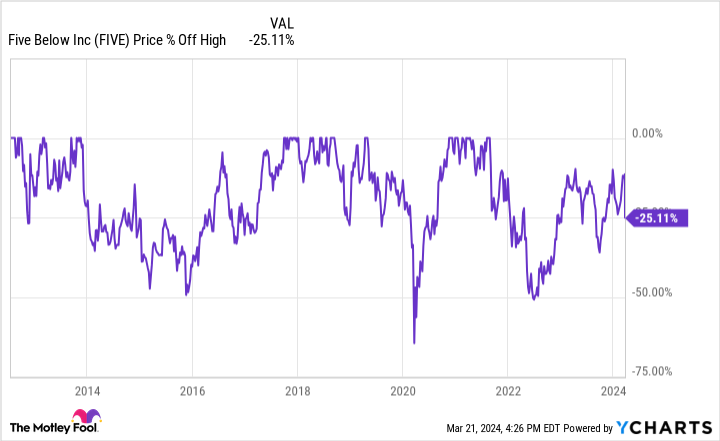

Five Below shareholders are used to pullbacks. Since the company went public in 2012, it’s fallen 15% or more quite a few times, as the chart below shows. For patient investors with a long-term focus, these pullbacks are great opportunities. Five Below is fast-growing, profitable, and has large aspirations that can turn this into a solid contributor to any stock portfolio.

FIVE Chart

Why I love Five Below stock

The Five Below investment thesis is devilishly simple. The company intends to open about 2,000 new retail locations by 2030. These locations pay for themselves in about one year. This means the company’s cash flow quickly soars without the company taking on risky financing. As Five Below’s cash flow soars, so too should its stock price.

Let’s see how this has played out for Five Below during the past 10 years. At the end of its fiscal 2013, Five Below had 304 locations. At the end of fiscal 2023, the company had 1,544 locations — an increase of 1,240 locations. These new locations have dramatically increased overall sales. And same-store sales increased in eight of the last 10 years, contributing to higher overall sales as well.

Five Below’s numbers paint a picture of how good these new locations have been for the overall business. At the end of 2013, the company had just $50 million in cash and $20 million in debt. And its net income for the year was $32 million. By comparison, Five Below generated net income of over $200 million in its fiscal 2023, finishing the year with $460 million in cash, cash equivalents, and short-term investments as well as zero debt.

Story continues

FIVE Revenue (TTM) Chart

Why I still love Five Below for 2024 and beyond

In short, Five Below has continued doing what it needs to do to be a good…

..