There are loads of ways to generate passive income. One of the best ways to supplement portfolio growth is to seek out dividend stocks.

But when it comes to dividend income, did you know that some opportunities may be more reliable than others?

Let’s break down five companies that are established dividend payers, and assess why holding each of these stocks over a long-term time horizon can lead to massive gains for your portfolio.

1. Hercules Capital

Hercules Capital (NYSE: HTGC) is a business development company (BDC). BDCs are a reliable source of dividend income because these companies are required to pay out at least 90% of their taxable income to investors each year.

While there are many types of BDCs, Hercules primarily focuses on high-yield loans to start-ups in the technology, life sciences, and renewable energy industries. Although start-ups can be risky, Hercules has demonstrated that it employs robust due diligence processes before making an investment. Over the years, the company has worked with notable businesses including Impossible Foods, Enphase Energy, and Lyft.

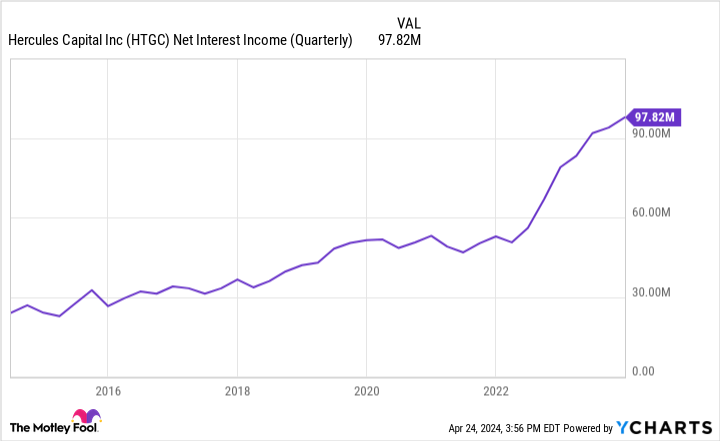

The company’s consistent rise in net interest income undermines Hercules’ strong performance and its proven ability to reward shareholders.

HTGC Net Interest Income (Quarterly) Chart

Over the last 10 years, Hercules stock has a total return of 275%. Not only does this emphasize the importance of reinvesting dividends, but it also highlights that Hercules has been a lucrative investment over the long run.

With its juicy dividend yield of 10.4%, now could be a great opportunity to scoop up shares in Hercules stock.

Image source: Getty Images.

2. Ares Capital

Another prominent BDC is Ares Capital (NASDAQ: ARCC). Unlike Hercules, Ares doesn’t typically work with high-profile tech companies that have raised funds from venture capital firms.

Rather, many of the companies in Ares’ portfolio are lower middle market businesses that go overlooked by investment banks or private equity investors.

Moreover, while Hercules specializes in basic debt instruments such as term loans or revolvers (think a corporate…

..