I’ve been investing for about 15 years. During that time, the vast majority of my investments have gone toward individual stocks. But I recently put a significant amount of my wealth, about 12%, into an exchange-traded fund, or ETF.

The ETF provides exposure to a segment of the market where I previously had none. It was a big hole in my portfolio, but it presents a great opportunity for long-term investors. And that opportunity looks increasingly appealing in today’s market.

While I could’ve done the research to learn about specific stocks in this segment, there were several reasons why I felt an ETF would work out better than relying on individual names. So, in the recent market sell-off, I bought shares of the Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV).

Why I finally pulled the trigger

Small-cap stocks have fallen out of favor recently. And by “recently,” I mean the last decade. Small-cap value stocks have fared even worse.

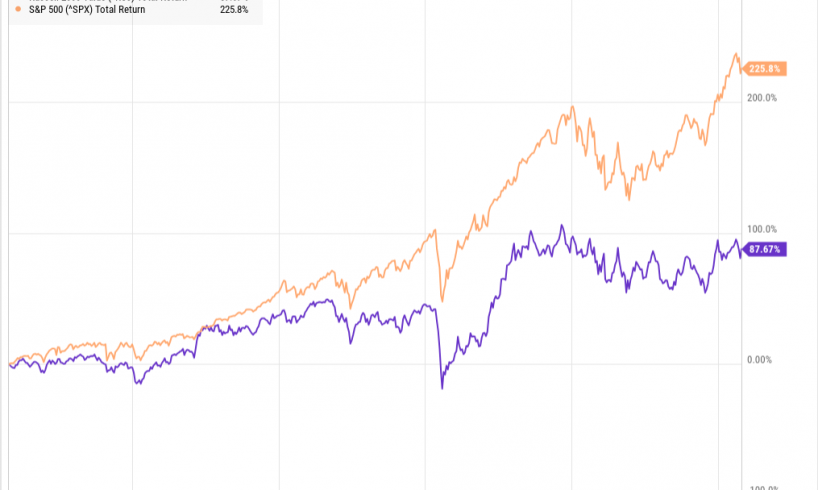

Here’s how the return of the Russell 2000 Value Index compares to the S&P 500 over the past 10 years.

^RUJ Chart

Small-cap value stocks have underperformed large-cap stocks in seven of the last 10 calendar years.

That’s led to a significant valuation gap. Small-cap stocks traded at 17% below their historic average forward price-to-earnings (P/E) ratio at the end of 2023. Meanwhile, large-cap stocks traded for 15% above their historic average, according to data compiled by American Century. That shows up in the Avantis U.S. Small Cap ETF’s trailing P/E ratio of 7.8, compared to the S&P 500, which has a trailing P/E of 26.2.

The valuation gap between small-cap and large-cap stocks hasn’t been this big in decades. That suggests there’s a lot more upside potential for small-caps than there is downside risk. That’s especially true given the very long-term historical trends.

Over the very long run, small-cap value stocks are the strongest-performing group of stocks in the investable market. And while that hasn’t worked out lately, there are fundamental reasons why it should remain true in the future. Specifically, small companies should have a…

..