As you may have learned recently, the “Magnificent Seven” is a group of powerhouse stocks including Nvidia, Apple, and Microsoft, most of which have benefited significantly from the enthusiasm surrounding their artificial intelligence (AI) efforts. But which would be the equivalent businesses if the same concept were applied to the healthcare sector rather than the technology sector?

As it turns out, there are only four stocks that have the right combination of ongoing growth and market-outperforming returns. All four of these magnificent healthcare companies have solid business models, upwardly trending share prices, and, unfortunately, somewhat frothy valuations.

But they also have very long growth runways and a history of good execution, so there’s a solid chance that their price tags will be justified by continued strong performance. Let’s meet the players.

Eli Lilly and Novo Nordisk

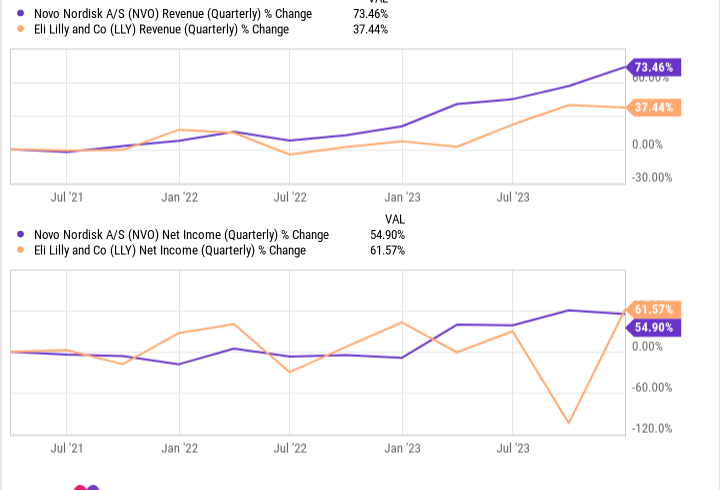

Eli Lilly (NYSE: LLY) and Novo Nordisk (NYSE: NVO) are two big pharma stocks that don’t need much introduction thanks to the increasingly absurd popularity of their smash-hit medicines for obesity and type 2 diabetes.

Eli Lilly makes the drug Mounjaro for diabetes as well as Zepbound, which is the same therapy but formulated for weight loss. It’s the largest healthcare company by market capitalization with a size of $729 billion.

Novo Nordisk is the second-largest healthcare competitor by market cap, clocking in at $549 billion. It’s responsible for the type 2 diabetes medicine Ozempic, as well as the obesity-oriented version of the same drug, Wegovy.

Both companies plan to continue the process of penetrating those same metabolic-disease markets, in addition to others, over the rest of the decade and beyond. Their pipelines are packed with mid-stage and late-stage programs that could become the perfect tools in a smattering of different medical niches, or which could expand the indications and addressable market of their already-approved medicines.

Story continues

And neither company anticipates much of a problem with competition over market share, given that the markets they’re…

..