The markets have experienced a period of volatility over the past month, raising questions about where they might be heading next. Has the year’s strong rally hit a brick wall, or is it just a pause before the next leg up?

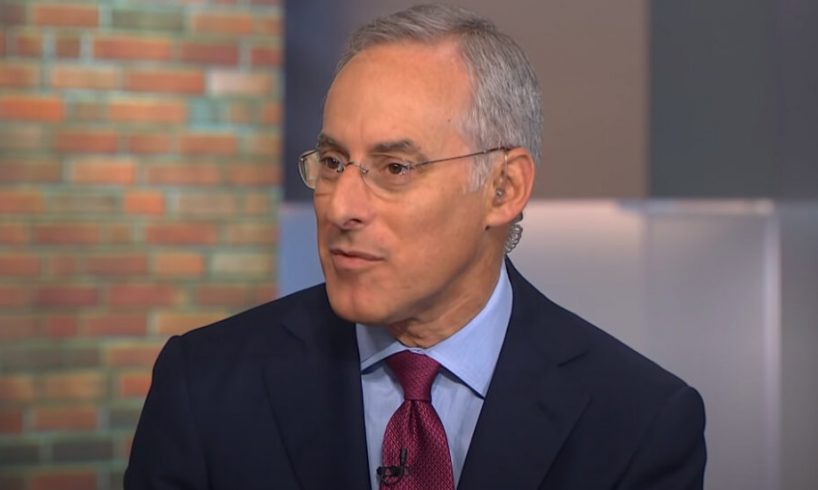

It’s a question that has been fielded to Goldman Sachs’ chief U.S. equity strategist David Kostin. The good news for investors is that going by the direction the wider economy is taking, Kostin makes some reassuring noises on the matter.

Decelerating inflation data offers confirmation that “disinflation is well under way,” while investors now see less of a risk for a recession given economic growth data has “remained robust.”

These positive developments point toward an outcome desired by stock market participants. “As the US economy nears a soft landing,” Kostin says, “investors have room to further increase their exposure to equities.”

If it’s time to expand exposure to equities, the next question naturally is: which equities exactly?

The analysts at Goldman have an idea about that too. They have pinpointed an opportunity in two names, and it looks like the rest of the Street is onside as well. According to the TipRanks database, both are rated as Strong Buys by the analyst consensus. Let’s find out why they are getting the thumbs up on Wall Street right now.

Sagimet Biosciences (SGMT)

The first Goldman pick we’ll look at is Sagimet Biosciences, a clinical-stage biotech firm, working on novel therapeutics called fatty acid synthase (FASN) inhibitors. These are intended as treatments for diseases such as non-alcoholic steatohepatitis (NASH), acne and different cancers. Sagimet has only been a public entity for a little over a month, having held its IPO in mid-July.

Sagimet has one drug candidate, denifanstat – an oral, once-daily pill in development for the treatment of nonalcoholic steatohepatitis (NASH). In collaboration with its Chinese partner Ascletis, the drug is also being developed as a potential treatment for acne and cancer.

Story continues

But it’s the NASH opportunity that is most under the microscope right…

..