(Bloomberg) — Asian shares crept higher while US and European stock futures inched lower as investors weighed a likely pause in interest rate hikes by the Federal Reserve against the risk of a debt default by Washington.

Most Read from Bloomberg

Shares in Australia fell as stocks in Japan and China registered muted gains amid unsettled trading. South Korea was a notable exception, with the Kospi advancing as much as 0.9%, on track for its sixth daily gain.

Contracts for the S&P 500 and the Nasdaq 100 were fractionally lower — adding to small declines on Friday — as were those for the Euro Stoxx 50.

The yen and the Swiss franc rose, reflecting a degree of demand for havens, while a dollar gauge fell slightly.

Treasuries rose, with the yield on the policy-sensitive two-year note falling four basis points. Australian and New Zealand government bonds were little changed.

President Joe Biden and House Speaker Kevin McCarthy are scheduled to meet in Washington following a “productive” call between the pair over the weekend. Yet one Republican negotiator is insisting on a multi-year spending limit, complicating talks even as default could come as soon as June 1.

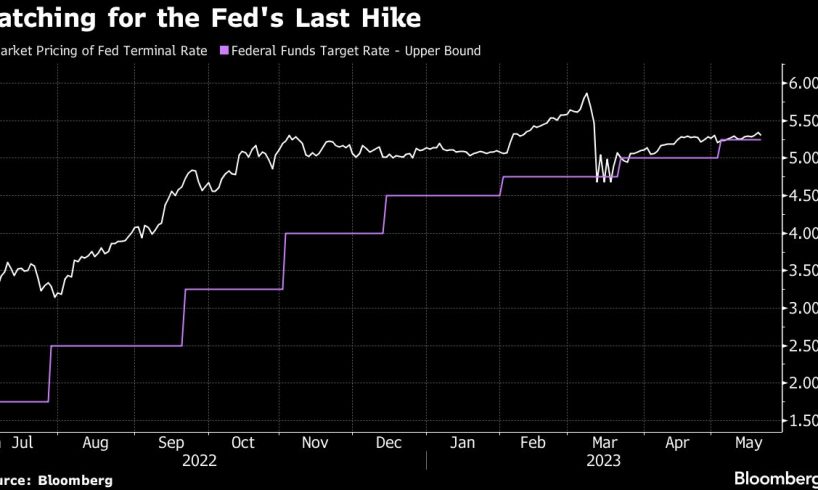

Traders also remain fixated on the path for Fed’s benchmark interest rate, with bets for a hike in June trimmed to 25% as Jerome Powell signaled a pause. Minneapolis Fed President Neel Kashkari also said he may support a pause, Dow Jones reported.

“Market pricing is firmly back to thinking the Fed will pause,” Chris Weston, head of research at Pepperstone Group Ltd., wrote in a research note. “The US debt ceiling, and the price action in US banks, are going to dominate the narrative.”

The S&P 500’s drop Friday halted a two-day rally as it failed to stay above the closely watched level of 4,200. The $3.2 billion SPDR S&P Regional Banking exchange-traded fund slumped almost 2% on a report that Treasury Secretary Janet Yellen told the chiefs of large lenders that more mergers may be needed.

Story continues

Stocks are primed to drop if the US fails to raise the debt limit and delays government payments….

..