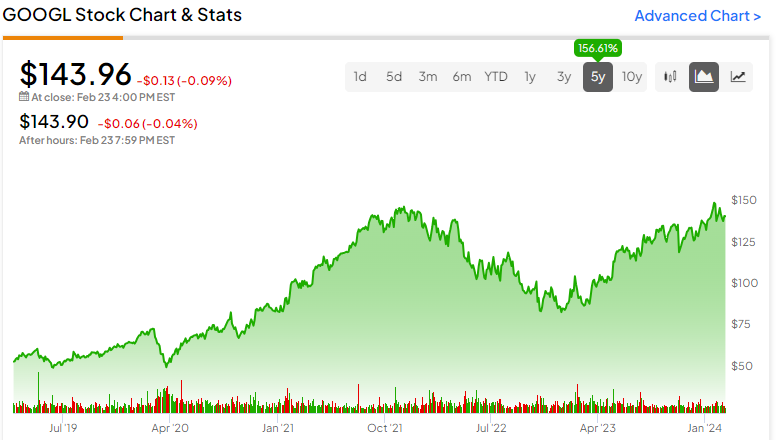

Magnificent Seven stocks have attracted plenty of buzz as investors gravitate toward their vast market share and exceptional returns. Every Magnificent Seven stock has more than doubled over the past five years. These assets have significantly outperformed the market during that time. However, Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) has been a largely underappreciated stock.

The corporation has amassed a $1.75 trillion market cap and is up by 56% over the past year. Still, that gain falls behind most of the Magnificent Seven stocks. New opportunities and a good valuation can help Alphabet gain momentum and accumulate long-term returns for investors. Those catalysts make me bullish on the stock.

Alphabet Has Underperformed the Magnificent Seven

Although the company owns the largest search engine in the world, it’s fallen behind the Magnificent Seven stocks in recent years. These are the one-year and five-year returns for each stock within the cohort.

One-year returns:

Nvidia: 223%

Meta Platforms: 171%

Amazon: 77%

Microsoft: 58%

Alphabet: 56%

Apple: 22%

Tesla: -2%

Five-year returns:

Nvidia: 1,579%

Tesla: 882%

Apple: 320%

Microsoft: 260%

Meta Platforms: 187%

Alphabet: 157%

Amazon: 106%

These are still impressive returns and outpace the S&P 500 (SPX) and Nasdaq 100 (NDX). However, Alphabet has been outclassed by every Magnificent Seven stock except Amazon (NASDAQ:AMZN) over the past five years.

Alphabet Trades at a Great Valuation

While the stock has underperformed its peers within the cohort, Alphabet has a better valuation than most tech companies. The stock trades at a 24.5 P/E ratio and has solid profit margins. The company’s net profit margin usually exceeds 20% and should get a big boost in future quarters.

Alphabet has three components on its side: rising revenue, more profits, and cost-cutting measures. The tech giant reported 13% year-over-year revenue growth and 51.8% year-over-year net income growth in Q4 2023. Alphabet’s efforts to trim its workforce contributed to higher margins and seem to be ongoing.

Story continues

A contributing factor to Alphabet’s rising net…

..