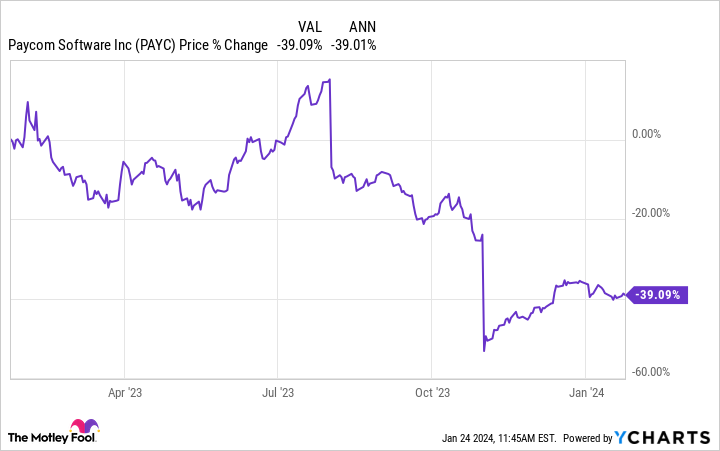

Not every stock rose last year. Consider these four — Nike (NYSE: NKE), MarketAxess (NASDAQ: MKTX), Paycom Software (NYSE: PAYC), and The Hershey Company (NYSE: HSY) — which fell between 10% and 42% in 2023. That stands in stark contrast to the S&P 500 index’s 23% rise.

Despite these worrying drops, nothing changed dramatically for the worse regarding any of the four dividend growers’ operations. This disconnect between declining share prices and each company’s leadership position in its niche may create opportunities for investors focused on the long haul.

These companies are home to well-funded dividends that offer the potential to grow far into the future. Here’s why these S&P 500 stocks are four of my top selections to buy in 2024 and hold forever.

1. Nike

With a total return north of 92,000% since its initial public offering (IPO) in 1980, Nike has an incredible track record of remaining the most dominant brand in footwear and apparel.

To help quantify just how powerful the Nike name is, consider that Kantar Brandz listed it as the 13th-most-valuable brand in 2022, ahead of businesses like Coca-Cola, Tesla, and Netflix. This top-tier brand power is noteworthy for investors. The companies in Kantar Brandz’s top 100 each year have posted stock returns stronger than the S&P 500 by a score of 357% to 245% since 2006.

Best yet for investors, Piper Sandler’s 2023 survey on U.S. teenagers’ spending showed that Nike remained the far-and-away leader in footwear and apparel, with 61% and 35% of respondents calling the company their favorite for each segment. This robust mindshare among Gen Z shoppers signals that Nike’s current struggles are temporary and should not be an ongoing problem as these young shoppers age and begin making more financial decisions on their own.

On the financial side, Nike pays a 1.4% dividend yield that only uses 40% of its net income, leaving a promising growth runway for investors seeking passive income. It’s grown this dividend by 11% annually over the last five years. Nike promises to reward patient investors who are willing to wait out the…

..