It seems like everyone and their uncle hate Intel (NASDAQ:INTC) today. This is a sign of how fickle the market can be, but I encourage you to look at the big picture and make your own decisions. When the dust settles in a while, I expect the market to appreciate Intel again, and for the long term, I am bullish on INTC stock.

Intel is a chipmaker that, unlike some of the company’s competitors, actually manufactures its own microchips. Having a foundry business is risky, no doubt, but it’s what sets Intel apart.

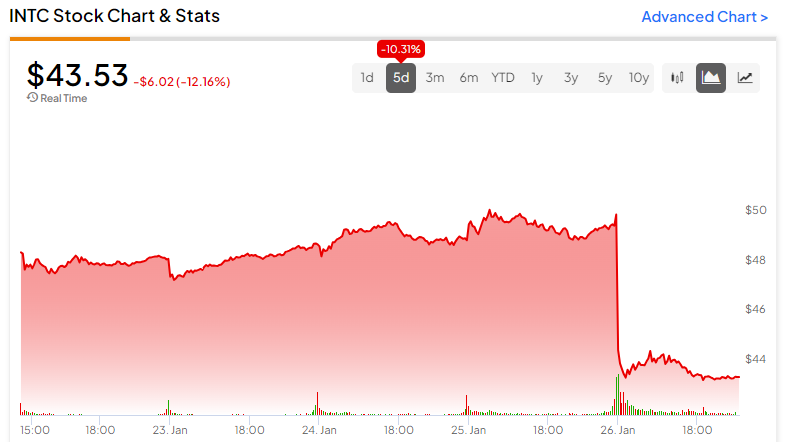

Today’s INTC stock dumpage is a textbook example of how investor sentiment can turn on a dime. In just a year’s time, Intel has gone from doghouse to darling and back. Don’t be frustrated at the market’s wild mood swings, though, since irrational behavior leads to volatility, and volatility leads to opportunity.

The Good News That No One is Talking About

INTC stock is down 12% today, even though there are multiple positive news items to report. In effect, the market is so hyper-focused on Intel’s quarterly report and forward guidance that it’s completely overlooking some important developments concerning Intel.

First of all, Intel just celebrated the opening of the company’s factory in Rio Rancho, New Mexico. According to Keyvan Esfarjani, Intel executive vice president and chief global operations officer, this represents the “opening of Intel’s first high-volume semiconductor operations and the only U.S. factory producing the world’s most advanced packaging solutions at scale.”

Furthermore, Intel announced a collaboration with Taiwan-based United Microelectronics Corporation (NYSE:UMC) to develop a “12-nanometer semiconductor process platform to address high-growth markets such as mobile, communication infrastructure and networking.” It’s interesting that Intel is partnering with a Taiwanese foundry business like United Microelectronics Corporation.

With this Taiwan-based partnership, could Intel and UMC be poised to steal significant market share from Taiwan Semiconductor (NYSE:TSM)? It’s a question that ought to be…

..