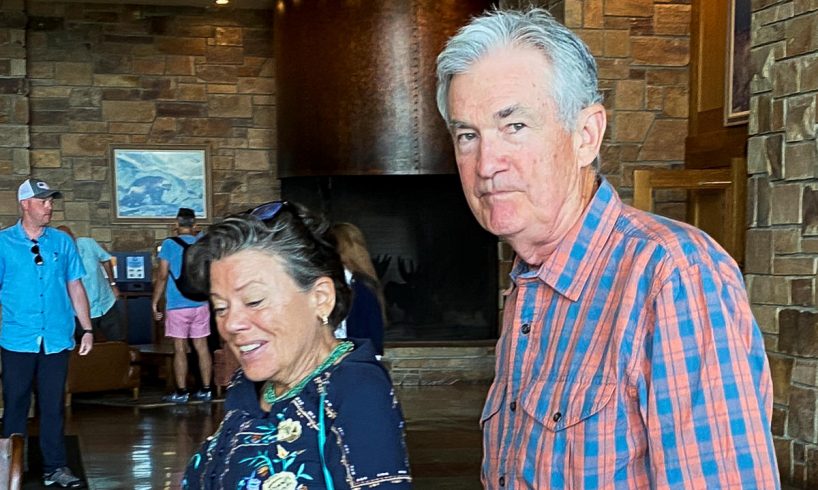

Wall Street ended the trading day on a positive note, as investors found their footing after Fed Chair Jerome Powell said the central bank is “prepared to raise rates further” at the annual Jackson Hole Economic Symposium in Wyoming.

Investors digested Powell’s comments in halting phases, at one point dragging all the major averages into the red. But the market settled on a balanced reading of the speech. While the Fed chief acknowledged inflation has come down from its peak, he reiterated that prices remain “too high,” leaving the door open for the central bank to continue tightening. In what some analysts have dubbed a Rorschach test, Powell’s remarks inspired both hawkish and dovish predictions of what comes next. Wall Street appears to have taken a slightly optimistic middle road.

The S&P 500 (^GSPC) edged up by about 0.7%, while the Dow Jones Industrial Average (^DJI) rose 0.7%, or more than 200 points. The tech-heavy Nasdaq Composite (^IXIC) climbed just under 1%, as the major averages won the day after Powell delivered a cautious message on the fight to bring inflation back to its 2% target.

The turn on Wall Street comes after Thursday’s retreat when stocks finished lower across the board as the Nasdaq fell nearly 2%, forfeiting gains from an early rally spurred by Nvidia’s (NVDA) strong earnings report.

Powell’s remarks reinforced prior comments by Boston Fed President Susan Collins — who spoke to Yahoo Finance’s Jennifer Schonberger in an interview from Jackson Hole — suggesting higher interest rates may be needed to tame inflation.

Last year, stocks sold off sharply during Powell’s speech in Jackson Hole, when he said the Fed would continue raising interest rates “until the job is done.” Since that speech, interest rates have risen an additional 300 basis points with the fed funds rate now at its highest level since 2001.

As Powell signaled the possibility of additional rate hikes, the bond market sent yields higher, with the yield on the two-year Treasury rising to 5.069%.

Story continues

Click here for the latest stock market news and in-depth…

..