The markets have been exhibiting some wobbly tendencies recently, with the strong rally seen in the first half of the year appearing to have wilted a bit under the summer sun.

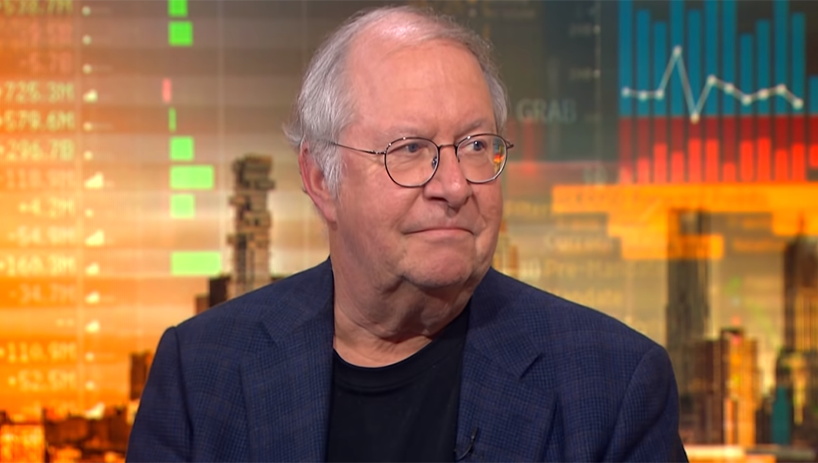

Fear not, however, appears to be the advice of one prominent stock picker. With US inflation falling to 3% recently compared to last summer’s 9%, and with GDP growth in the last quarter coming in at 2.4%, famous value investor Bill Miller, whose net worth is valued at $1.4 billion, thinks the rest of the year looks pretty good for the stock market.

“It’s entirely possible that we’re going to get back to a 2% inflation rate by the end of this year,” says Miller. “If we do so without experiencing a recession and with earnings being okay, that would give you a much, much higher justified valuation in the market than we’re at right now.”

With such a positive outlook, then, it makes sense to find out which stocks Miller believes will keep on delivering the goods. In this regard, we took a closer look at two dividend stocks, offering yields of up to 9%, which are currently held by Miller’s firm, Miller Value Partners. Here’s what we found.

CTO Realty Growth (CTO)

We’ll start with CTO Realty Growth, a real estate investment trust (REIT) focused on shopping mall and retail niche properties. The company’s portfolio features assets in Southeast and Southwest of the US, and leans heavily on high-quality, income-generating properties. CTO also holds a significant stake in Alpine Income Property Trust, another retail-oriented REIT.

CTO doesn’t choose its property investments solely for their ability to generate current income; the company is also focused on future income potential. More than half of its portfolio investments – 13 out of 21 properties – are located in Florida, Georgia, or Texas, three of the fastest-growing US state economies. By GDP growth, all three states rank in the top 10.

Continuing on the momentum seen during the first quarter, the company delivered a strong set of results in Q2. The top line came to $26.05 million, for a 34% increase year-over-year and…

..