(Bloomberg) — Japan is leaving China behind as Asia’s two largest stock markets compete for investor capital, with the latter’s prospects clouded by long-running concerns about economic growth and geopolitical tensions with the West.

Most Read from Bloomberg

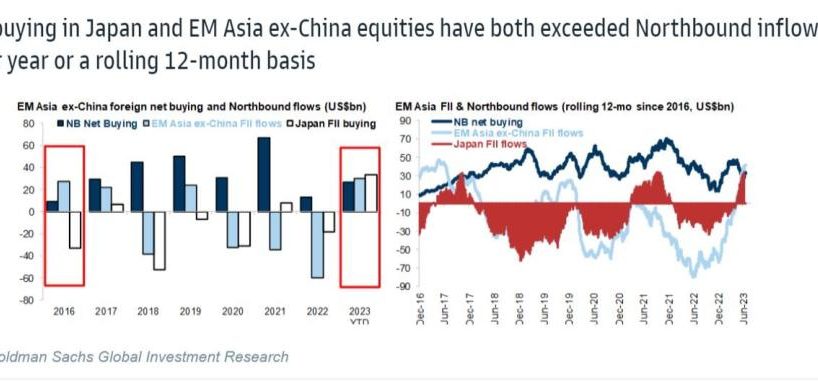

Foreign buying of Japanese equities has exceeded that of Chinese peers for the first time since 2017, according to a Goldman Sachs Group Inc. report, which cited data for the first six months of the year. Long-only managers continued to sell stocks in China and Hong Kong on a net basis in July despite a sharp rally, while buying shares in Japan, strategists at Morgan Stanley wrote in a report last week.

The tide has turned in favor of Japan as global funds pile into a market they once shunned due to concerns over lackluster earnings growth. Optimism is running high even after the Bank of Japan adjusted its accommodative stance, as investors seek alternatives to Chinese equities amid a lack of conviction that Beijing’s pledges to support a faltering economy will bear fruit.

“There were two main policy events in Asia in the last week of July, the BOJ meeting and the Politburo meeting, none of which change our view of Japan equities outperforming China,” said Frank Benzimra, head of Asia equity strategy at Societe Generale SA. “The reason is that we get increasing signs that the monetary policy normalization in Japan is going to be extremely gradual, which means the yen is not rapidly re-appreciating.”

READ: China Rally Is Just an Opportunity to Sell for Many Global Funds

Allianz Oriental Income, an Asia-focused fund with $1 billion in assets, has been boosting holdings of Japanese equities at the expense of China as part of a reallocation across the region. Japan’s weighting in the fund stood at 40% at the end of June, five times its China exposure, according to a factsheet.

Story continues

The fund has returned 14% in the past year to beat 96% of its peers. Its weightings for Japan and China were 25% and 16%, respectively, as of end-2022.

Even a potential appreciation of the yen if the BOJ abandons…

..