Text size

“It was a tough quarter, but we are seeing good, positive signs for the future,” Sumit Sadana, Micron’s chief business officer, recently told Barron’s.

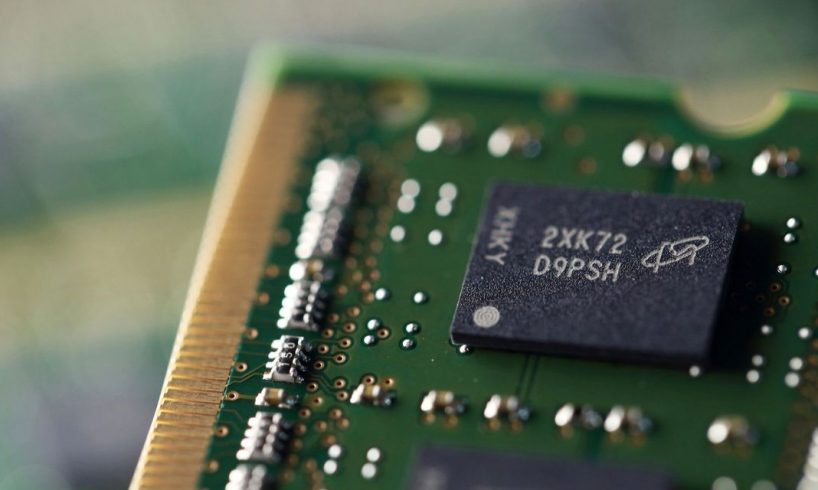

Tomohiro Ohsumi/Bloomberg

Ah, April. The crack of the bat. The smell of fresh-cut grass. The frantic search for year-old receipts. And the sound of conference calls ringing in the air. It’s baseball season. It’s tax season. And even better, it’s first-quarter earnings season.

The first quarter of 2023 was a remarkably profitable one for tech investors, helping to turn the corner on a nightmarish 2022. Stocks that were pummeled last year have rebounded with strong gains. The seven tech companies with market values above $500 billion—

Apple

(ticker: AAPL),

Microsoft

(MSFT),

Alphabet

(GOOGL),

Amazon.com

(AMZN),

Nvidia

(NVDA),

Tesla

(TSLA), and

Meta Platforms

(META)—have each rallied at least 20% in 2023, outstripping a 7% gain for the

S&P 500

index. Investors think the Federal Reserve is nearly finished tightening monetary policy—and they anticipate steady and then declining rates. As a result, miserable first-quarter results—and they almost certainly are going to be pretty bad—might not matter.

You could see that dynamic in the recent earnings report from memory-chip producer

Micron Technology

(MU). With…

..