(Bloomberg) — Stock pickers who successfully navigated the 2022 bear market are having a harder time making it through the 2023 faltering recovery.

Most Read from Bloomberg

First, an unexpected risk-on rally in January caught some defensively positioned mutual funds off-guard. Then, stocks started falling pretty much in unison on renewed anxiety about how far the Federal Reserve will go with its rate hikes, ruining efforts to find some way to come out ahead. And as long this one-way wave lasts, equities traders will find few opportunities to make money.

Consider that the correlation between the movement of growth and value stocks has jumped to the highest level since at least 2005, data compiled by 22V Research show. How are stock pickers supposed to find market dislocations when value and growth are doing the same thing?

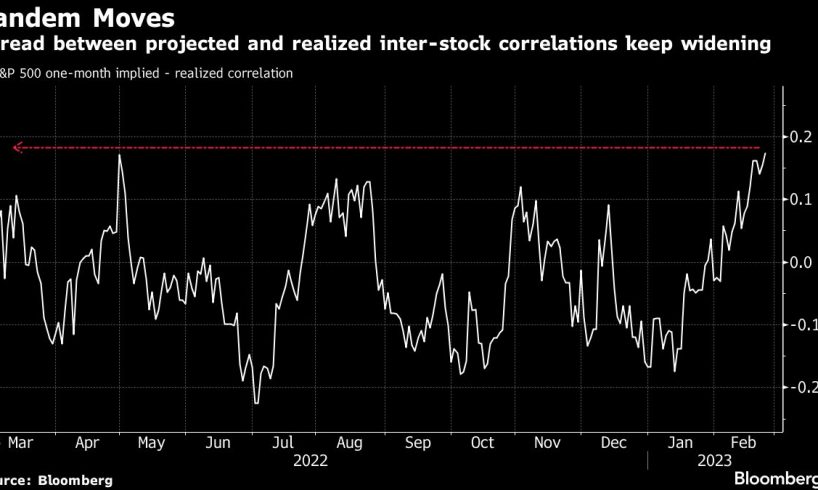

What’s more, the trend seems unlikely to change: A gauge that measures how in sync stocks are expected to move in the future relative to the past has jumped to nearly a one-year high.

To Michael O’Rourke, chief market strategist at JonesTrading, S&P 500 stocks will continue to move in closer lockstep until the market is done pricing in the prospect that the Fed will raise its benchmark rate as high as 5.5%. The repricing got underway this week. In the swaps market, traders are now pricing in a 25 basis-point rate hike at each of the next three Fed meetings, which would push it to a range of 5.25%-5.5%.

The S&P 500 responded by falling 1.1% on Friday and posting its worst week since December. But the full reaction will likely come with a lag, according to O’Rourke.

“When the dispersion among the S&P 500 members emerges all depends on how quickly it takes for the majority of market participants to realize” that rates are staying higher for longer, he said. “What we are seeing today is the market finally acknowledging that there is no ‘policy pivot’ on the horizon.”

Story continues

Challenging Conditions

The fact that the market is back to being driven almost entirely by speculation about the Fed’s path is vexing for active fund…

..