(Bloomberg) — US equity-index futures fell as concern the Federal Reserve will keep borrowing costs higher for longer outweighed optimism over China’s economic recovery.

Most Read from Bloomberg

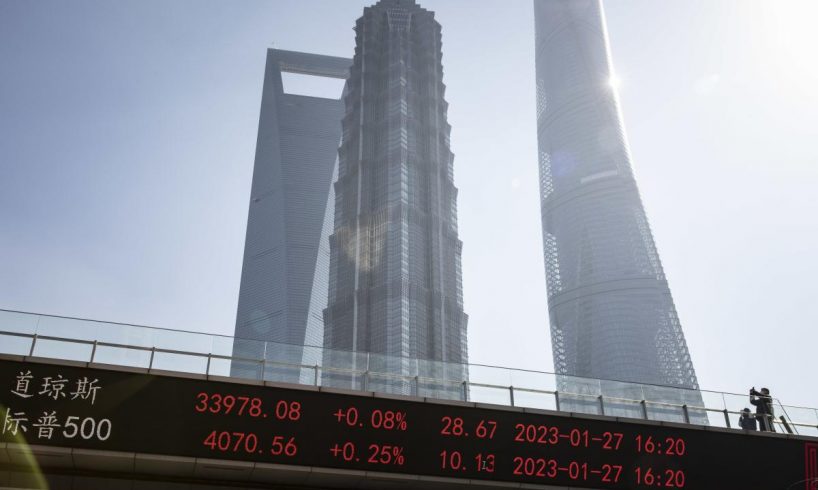

Contracts on the S&P 500 Index slipped 0.2% as trading was muted amid a US holiday. The Stoxx Europe 600 Index was marginally higher after fluctuating in a tight range throughout the day. The Shanghai Composite Index climbed the most since November. Treasury futures were lower as investors assessed hawkish comments by Federal Reserve officials. The dollar took a breather from a three-week rally.

A chorus of investors including Goldman Sachs Group Inc. is betting on Chinese equities to resume a rally as the world’s second-biggest economy deepens stimulus and relaxes pandemic restrictions. While this has sparked inflows into global assets tied to the Chinese economy, the broader sentiment in markets remains impaired, with the Fed resolute on its fight against inflation. Growing geopolitical tensions are also preventing investors from turning more bullish.

“2023 will be much bumpier than the current performance would suggest,” Luca Fina, head of equities at Generali Insurance Asset Management, wrote in a note. “It would make sense to reduce the cyclicality of portfolios — adding some cheap year-to-date losers that should perform better in a higher-volatility and uncertainty scenario (and) by reducing those who are currently more expensive and pricing a Goldilocks scenario.”

Europe’s Stoxx 600 was little changed, with consumer and technology stocks acting as a drag, even as commodity names rallied. In China, stocks gained after a Goldman report that penciled in a rebound on the back of an earnings recovery. Calls for further stimulus via lower rates also built up, prompting the nation’s banks to keep their lending rates unchanged.

Story continues

Contracts on the S&P 500 and Nasdaq 100 indexes slipped, with Treasury futures dropping across the curve. Stocks ended last week on a muted note after Richmond Fed President Thomas Barkin and Fed Governor Michelle…

..