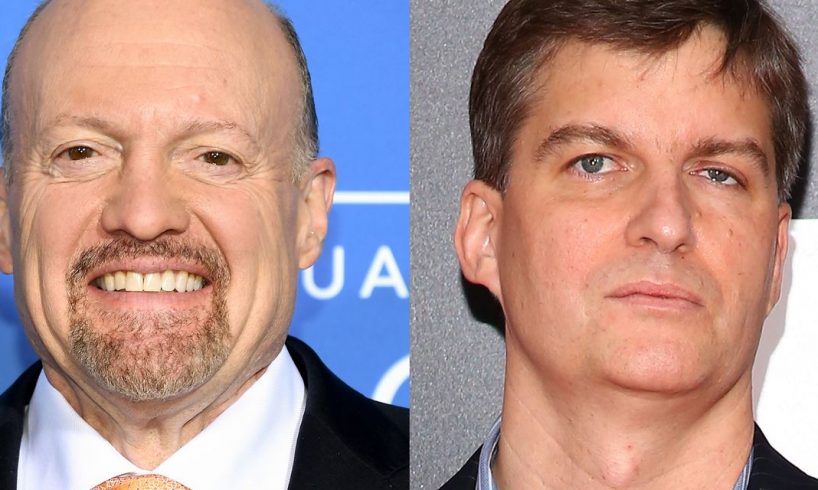

Michael Burry, the hedge-fund manager at Scion Asset Management who correctly forecast the 2008 financial crisis, on Tuesday night sent out a one-word tweet: “Sell.” Burry didn’t elaborate, but it’s not hard to fill in the blanks.

Assets like bitcoin and ARK Innovation ETF surged in January, in a seeming dash for trash on the view the Fed’s going to pivot to rate cuts soon, which is a lot to stomach for a value-focused investor like Burry.

On the other end of the spectrum, Jim Cramer says it looks like we’re in a bull market now. “If we’re in a bull market, and I think we are, you have to prepare yourself,” said Cramer, whose penchant for mistimed comments has spawned a fund that is seeking Securities and Exchange Commission approval to bet against his views. “We have to prepare for the down days now because in a bull market, they’re buying opportunities,” the CNBC commentator added.

It’s possible neither Burry nor Cramer is correct.

Take the final day of January, in which stocks surged on data showing the employment cost index decelerated to a 1% quarterly rate, which was below expectations and importantly below the 1.2% of the third quarter. At the same time, though, the index is running 5.1% year-over-year.

Neil Dutta, head of economics at Renaissance Macro Research, was explaining to Barry Ritholtz of the Masters of Business podcast what that number means to the Fed. “For whatever reason, the Fed views the labor markets as the conduit [to inflation]. And if compensation growth is running, right now, let’s say it’s 5%, and productivity is 1%, one and a half, you’re basically talking about an inflation environment of three and a half percent-ish,” Dutta said.

Dutta, who got his start working with David Rosenberg at Merrill Lynch, later came back to the topic. “If wage inflation is still running at four and a half, 5%, it’s going to be difficult [for the Fed to cut]. I mean, I hate to say it like this, it just means the disinflation that you’re going to see this year is also transitory.”

If Dutta is…

..