(Bloomberg) — Stocks made small advances while currencies were mixed in Asia on Monday amid cautious trading and reduced liquidity with many markets closed for holidays.

Most Read from Bloomberg

Benchmark equity indexes for mainland China, Japan and South Korea climbed less than 1%, with a gain of just above that for India. Other markets including Hong Kong, Singapore and Australia were shut.

Appetite for risk taking was limited, with the positive impact from recent US inflation data partly offset by concern over China’s ability to cope after abandoning its Covid Zero policy.

Amid a new wave of infections, China’s National Health Commission said it would stop publishing daily case numbers for the coronavirus, complicating the task for investors trying to assess the economic impact.

Meanwhile, data on Friday showed the Federal Reserve’s closely watched measure of inflation cooling and consumer spending stagnating. Consumers’ year-ahead inflation expectations also dropped this month to the lowest since June 2021, a survey by the University of Michigan showed.

While US equities closed higher on Friday, the S&P 500 and the tech-heavy Nasdaq 100 still suffered weekly losses.

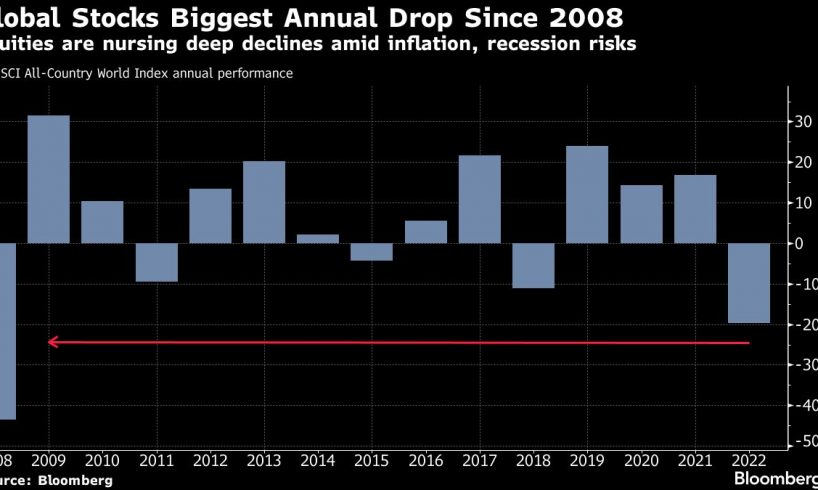

Looking across all the year for global equities, 2022 has been the worst annual performance in more than a decade.

“The Fed has been telling us they are going to tighten financial conditions until a recession or something ‘breaks’,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “This is not a great place to own speculative assets, especially the long-duration variety telling me in times like this, cash itself is the best at the money put.”

Story continues

The offshore yuan and the euro edged higher while the Australian dollar erased earlier losses. Most Group-of-10 currencies traded within narrow ranges against the greenback.

The yen strengthened versus the dollar, even after Bank of Japan Governor Haruhiko Kuroda stressed that the BOJ’s latest adjustments to yield control were not the beginning of an exit of monetary easing.

Traders are skeptical of…

..