(Bloomberg) — Investors ready to turn the page on the worst year for equities since the global financial crisis should brace for more pain heading into 2023.

Most Read from Bloomberg

That’s the blunt message from top strategists at Morgan Stanley, Goldman Sachs Group Inc. and others, who are warning that stocks face fresh declines in the first half as corporate earnings succumb to weaker economic growth and still sky-high inflation, and central banks remain staunchly hawkish.

The second half will mark a recovery once the Federal Reserve stops hiking rates, they say — but it’s likely to be a muted rebound that will still leave stocks only moderately higher than at the end of 2022.

“The risks that stock markets grappled with this year aren’t over and that makes me nervous about the outlook, particularly in the first half,” Mislav Matejka, global equity strategist at JPMorgan Chase & Co., said in an interview.

The average target of 22 strategists canvassed by Bloomberg has the S&P 500 ending next year at 4,078 points — about 7% higher than current levels. The most optimistic forecast is for a 24% increase, while the bearish view sees it slumping 11%. In Europe, a similar survey of 14 strategists projected average gains of about 5% for the Stoxx 600.

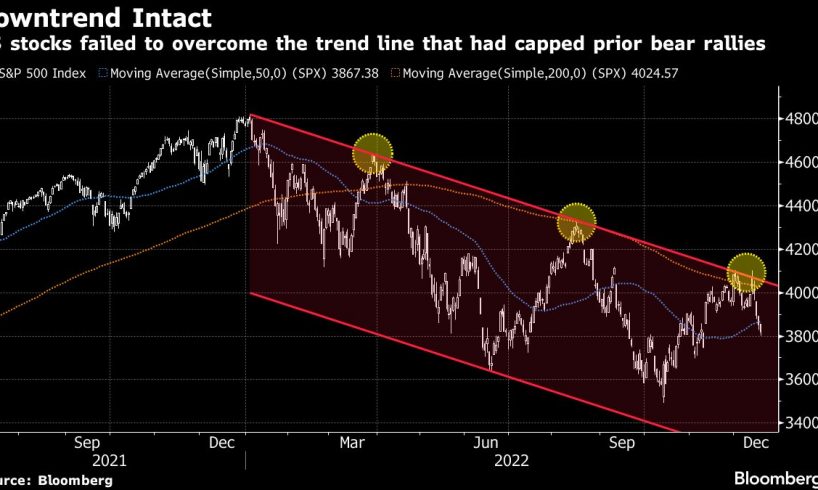

The cautious central case reflects the mountain of challenges from monetary tightening to the war in Ukraine and Europe’s energy crisis. The first of those has already helped quench a recent stock rally.

Even the better news on inflation has come with a big caveat because it hasn’t swayed central banks from their focus on getting it under control. Hawkish tones from both the Fed and the European Central Bank last week sparked sharp equity declines, and reminded investors that timing the long-awaited policy shift won’t be simple.

Story continues

If that message wasn’t getting through already, the Bank of Japan hammered it home on Tuesday with a shock tweak to its bond-yield policy.

To be sure, consecutive down years are rare for US stocks, so after this year’s drop, there’s only a low probability they…

..