As the holiday season kicks off, many of us will be diving into shopping with an eye for bargains. Done well, it can make those expenses feel a little lighter. And the same goes for stock picking.

When it comes to equities, bargain hunting usually involves finding beaten-down stocks that remain fundamentally sound. They may have gotten caught up in a cyclical downturn – after all, there’s a reason the share price is down – but they aren’t necessarily bad portfolio options.

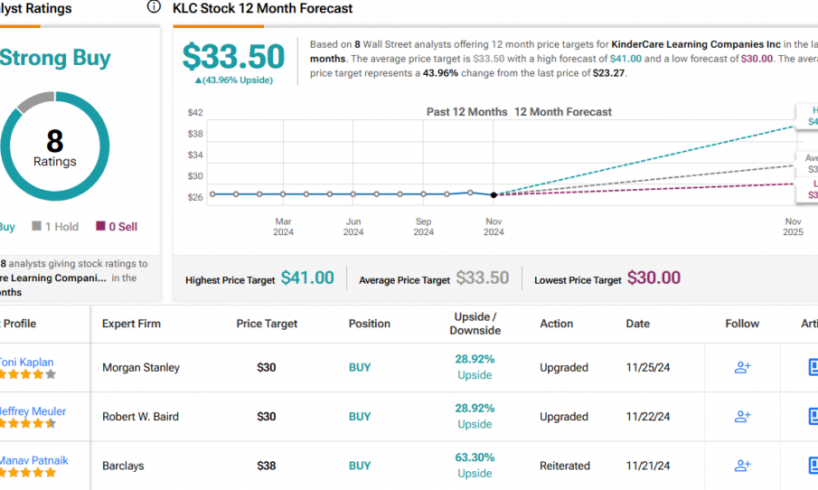

To uncover such opportunities, turning to Wall Street’s stock analysts can provide valuable insights. These experts have recently spotlighted two beaten-down stocks that could stage a comeback in 2025.

Using the TipRanks database, we’ve explored these two picks to understand why they might be poised for double-digit gains in the near future.

KinderCare Learning Companies (KLC)

The first stock on our beaten-down list is KinderCare, an early childhood education company that is part of the for-profit educational and child development sector. The firm was founded back in 1969 and is currently based out of Portland, Oregon; its network of educational centers extends across 40 states and is capable of serving up to 200,000 kids. This network includes some 1,500 branded early childhood education centers, and it is backed up by approximately 900 sites for before- and afterschool programs. The company also operates the line of Crème Schools, a premium early education network that offers parents and students engaged learning environments in a variety of themed classrooms. All in all, KinderCare has programs for children from the age of 6 weeks all the way up to 12 years.

While KinderCare has been in the early childhood education business for decades, the company only went public in October of this year. The KLC stock ticker entered the trading markets through an IPO that saw the company raise $576 million in gross proceeds. The offering closed on October 10 with shares priced at just over $28; since then, the stock has been falling – and it has lost 20% in November alone.

KLC’s…

..