(Bloomberg) — Asian stocks traded mixed Monday as investors assess the impact of China’s Covid policies on growth and the outlook for the world’s largest economies. The dollar and Treasuries retreated.

Most Read from Bloomberg

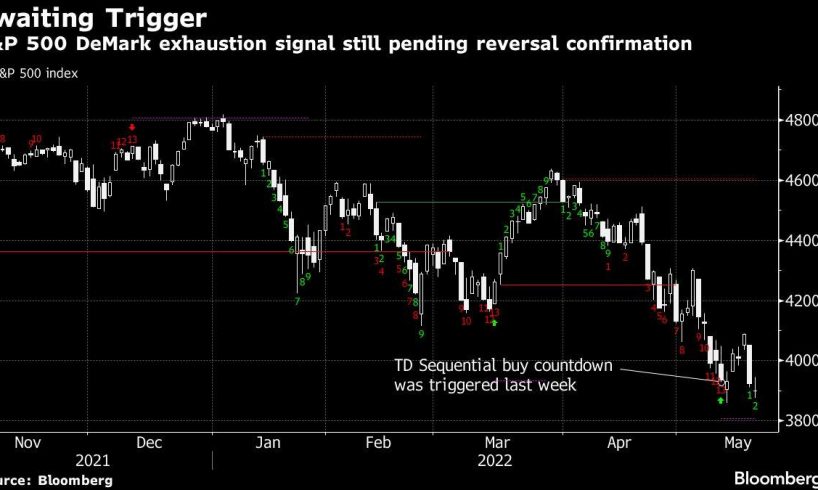

Equities rose modestly in Japan, but a slide in Chinese tech stocks and a virus outbreak in Beijing weighed in Hong Kong and China. Nasdaq 100 and S&P 500 futures jumped about 1% after the S&P 500 dropped for a seventh straight week in a stretch of weakness not seen since 2001.

Beijing reported a record number of Covid cases, reviving concerns about a lockdown. China’s stringent Covid Zero policy has stifled economic growth and prompted banks last week to cut a key interest rate for long-term loans by a record amount.

A dollar gauge declined. The Australian dollar gained after a weekend election delivered a clear outcome, with Labor ousting the Liberal-National coalition. Treasuries pared Friday’s advance as traders debate the Federal Reserve’s tightening path amid mounting worries about an economic slowdown. Bitcoin recovered from some weekend weakness to trade around $30,000.

Read: Stock Selloff to Intensify as Fresh 10% Plunge Looms: MLIV Pulse

Read: After Meltdown, Tech-Bottom Signals Have Yet to Scream ‘Buy Now’

Investors are grappling with concerns about an economic slowdown and prospects for more monetary tightening. The war in Ukraine is fanning commodity prices, and supply chains remain disrupted by China’s adherence to its Covid zero policy.

“As macro-economic concerns stemming from aggressive monetary tightening, the Russia-Ukraine conflict and China’s stringent Covid lockdowns persist, we anticipate great volatility in the market,” Louise Dudley, portfolio manager global equities at Federated Hermes Ltd., said in a note.

Story continues

Minutes of the most recent Fed rate-setting meeting will give markets insight this week into the US central bank’s tightening path. St. Louis Fed President James Bullard said the central bank should front-load an aggressive series of rate hikes to push rates to 3.5% at year’s…

..