There are six publicly traded companies with trillion-dollar valuations. With a market cap of roughly $1.9 trillion, Amazon (NASDAQ: AMZN) is the fifth-most-valuable company in the world, trailing peers including Apple, Microsoft, Nvidia, and Alphabet.

For now, Apple, Microsoft, and Nvidia are steadily in the lead as each boasts a market cap in excess of $3 trillion. However, I think Amazon has the best chance of becoming Wall Street’s first $5 trillion stock.

Below, I’ll break down how artificial intelligence (AI) represents a lucrative growth opportunity for all of big tech and why I think Amazon will emerge as the king of the tech realm in the long run.

Amazon’s next big catalyst

For the last couple of years, investors have been bombarded with information, most of it vague, about AI and how large corporations plan to integrate the technology into their businesses.

Promises of increased workplace productivity or enhanced data analytics don’t mean much unless you can prove that these technology upgrades are worth the money. The most obvious way to do that is through numbers.

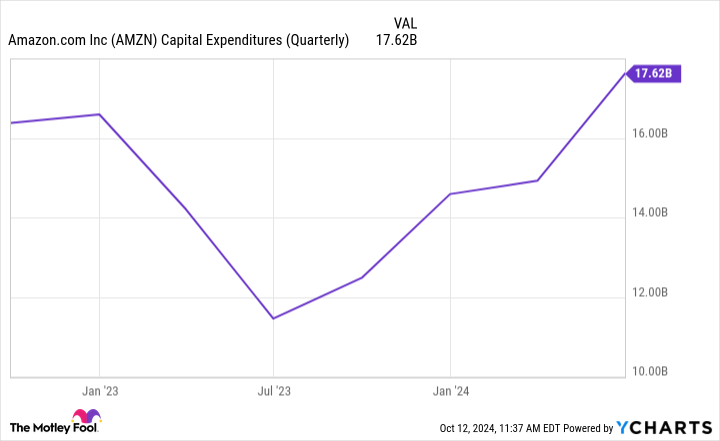

Since the AI revolution took off, Amazon has invested billions of dollars in new products and services. Specifically, the company invested $4 billion in a competitor to OpenAI, Anthropic. Additionally, the company has poured billions of dollars of capital expenditures (capex) into data center infrastructure.

Let’s take a look at how these investments are paying off and what that could spell for Amazon’s future.

AMZN Capital Expenditures (Quarterly) Chart

Revenue growth is great, but rising profits are even better

Despite the exciting prospects of AI, Amazon is facing other financial challenges. Macroeconomic forces, including stubborn inflation and rising interest rates, have stalled Amazon’s growth in core segments such as e-commerce and subscription services over the last couple of years. Thankfully, changes to monetary policy, such as reduced interest rates, should help ignite some renewed growth in these operating segments.

Where I think investors are completely overlooking Amazon is in its…

..