Energy Transfer (NYSE: ET) is offering investors an ultra-high 8% distribution yield. Enterprise Products Partners (NYSE: EPD) has a yield of 7.2%. Although both hail from the midstream energy sector, they are not interchangeable investments. Here’s why lower-yielding Enterprise is worth buying hand over fist and most will probably be better off avoiding Energy Transfer.

The problem with Energy Transfer

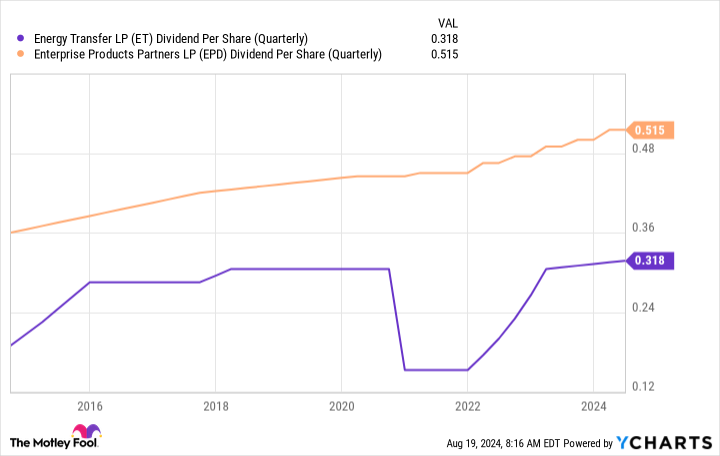

When energy prices plunged early in the coronavirus pandemic, Energy Transfer cut its distribution 50%. That 2020 distribution cut was, perhaps, justified by the uncertainty the world faced at the time, but it certainly was not the distribution outcome the investors were hoping for. And while the master limited partnership’s (MLP) distribution has started to rise again and is actually higher than it was before the cut, investors that care about income consistency shouldn’t ignore the choice that management made in 2020. It opens up the very real risk that the next energy industry downturn will lead to the same outcome.

Still, a distribution cut in the face of energy industry adversity is understandable. What’s harder to explain with Energy Transfer is the failed 2016 agreement to buy Williams Companies. Energy Transfer initiated the deal, but an energy downturn resulted in the MLP getting cold feet. Energy Transfer then worked to scuttle the deal, claiming that consummating it would require taking on too much debt, cutting the dividend, or both. The effort to get out of the agreement included issuing convertible securities, which is where the real problem comes in.

The CEO bought a large portion of the convertible securities at the time. The security would have effectively protected the CEO from the impact of a dividend cut if the deal went through as planned while leaving unitholders to feel the full brunt of a cut. It was a complicated affair, but that’s a top-level, and unsettling, view. That CEO, Kelcy Warren, is now “just” the chairman of the board, so there’s still good reason to be worried about what happened nearly a decade ago.

Overall, if you are looking…

..