The S&P 500 is one of the most referenced measures in investing. This index includes 500 of the world’s largest publicly traded companies and is often used as a proxy for how the overall stock market is performing. The index isn’t just 500 random companies, but rather ones that are large enough and have met certain key criteria such as sustained profitability.

While companies in the S&P 500 are generally strong businesses, even the best can go through rough stretches. Using the index as a starting point and searching for stocks that have fallen can be an interesting way to look for investment opportunities. Here are two stocks in the S&P 500 that have fallen at least 20% and why they are worth buying now and holding forever.

Chipotle Mexican Grill

Mexican fast-casual restaurant Chipotle Mexican Grill (NYSE: CMG) has been among the best-performing restaurant stocks ever. A $1,000 investment at its initial public offering (IPO) would be worth $61,000 today. However, over the past month, the stock is down 22%. This quick drop is even more interesting considering there’s been no major news or earnings reported.

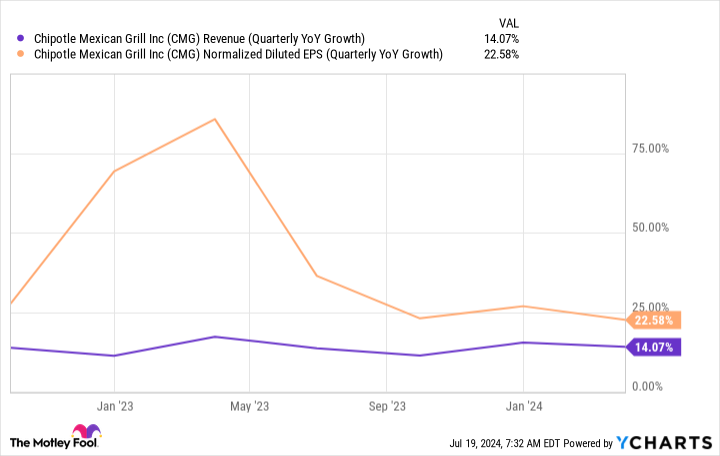

Given the business results, today’s price could be a compelling buying opportunity. In the most recently reported quarter, the first quarter of 2024, Chipotle’s revenue grew 14% year over year while its earnings per share (EPS) increased by 24%. This was a continuation of what has been a multiyear stretch of growth on both the top and bottom lines.

CMG Revenue (Quarterly YoY Growth) Chart

What’s impressive about this is the fact that the revenue growth has come both from new stores and also steadily increasing comparable restaurant sales. In Q1, Chipotle grew its comparable restaurant sales by 7% and its total store count by 8%.

These results are in line with the last several quarters and demonstrate the strength of the business as well as the room it has to continue to grow. Chipotle has a long-term goal of reaching 7,000 stores, which would be more than double the current store count.

PayPal

When it comes to digital payments, PayPal (NASDAQ: PYPL) could be the…

..