Every market rally can have a bad day, and that’s what we saw yesterday. After a tremendous run, both long and short term, the NASDAQ had its worst day since December 2022, dropping almost 3% and falling to a two-week low. A drop in the mega-cap tech stocks has powered that decline, as worries over tighter trade restrictions with China and investor moves toward broadening the base have pulled money out of the major tech companies.

While the market consensus would tell us that this bad day is not likely to push the bulls off track, a turndown like this makes it a good time to look at defensive stock plays.

The natural defense, of course, rests with the dividend stocks. These shares pay out a regularly scheduled income stream, regardless of market conditions, and the best of them ensure a sound return no matter how the markets turn.

So, if yesterday’s bad day has you seeking out high-yield dividends, the Street’s analysts are suggesting two div stocks to buy right now. These are shares that offer dividend yields of up to 12%, a yield that should turn heads in any economic environment.

We’ve used the TipRanks database to look up the broader view on both; these are Buy-rated shares, offering investors a strong defensive return as a portfolio foundation. Here are the details.

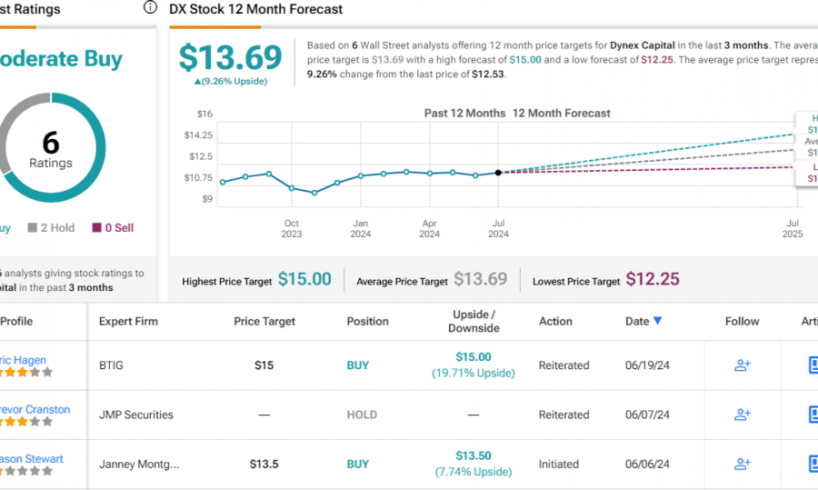

Dynex Capital (DX)

The first stock that we’ll look at is a real estate investment trust, a REIT. These companies are perennial dividend champs, and for good reason: in response to tax regulations, they typically pay out a high percentage of their profits directly to shareholders. Dynex Capital is a fairly typical REIT, with a portfolio composed mainly of MBSs, or mortgage-backed security instruments, mainly in the residential market although the company does have exposure to commercial mortgages as well. Dynex also maintains a significant portfolio position in both commercial and securitized single-family residential mortgage loans.

Dynex maintains a consistent strategic stance in putting its portfolio together. The starting point is a focus on preserving capital while seeking out stable…

..