Artificial intelligence (AI) is a truly revolutionary technology that has captured the imagination of investors like few things before. This is a double-edged sword, even if the tech really is here to stay. If we learned anything from 2000, it’s that too much hype around new technology without the economics to back up sky-high valuations is dangerous territory to be in.

I don’t want to draw too close a parallel here — there are plenty of reasons to believe this is not dot-com bubble round two — but it is always prudent to maintain a healthy skepticism during a boom. All eyes — skeptics’ and believers’ alike — are on Nvidia‘s (NASDAQ: NVDA) upcoming annual shareholder meeting.

On June 26, 2024, the figurehead of the AI revolution will hold the meeting, discussing strategy and holding votes on action items like board approvals. Typically, annual general meetings don’t move the needle as much as earnings reports do, but it’s still an important event that could help shed light on what the future holds for Nvidia and the market as a whole.

So, with the meeting fast approaching, is it a good time to hop on board the Nvidia train? Here are three reasons the stock still looks strong.

1. Nvidia has a lot of cash to play with

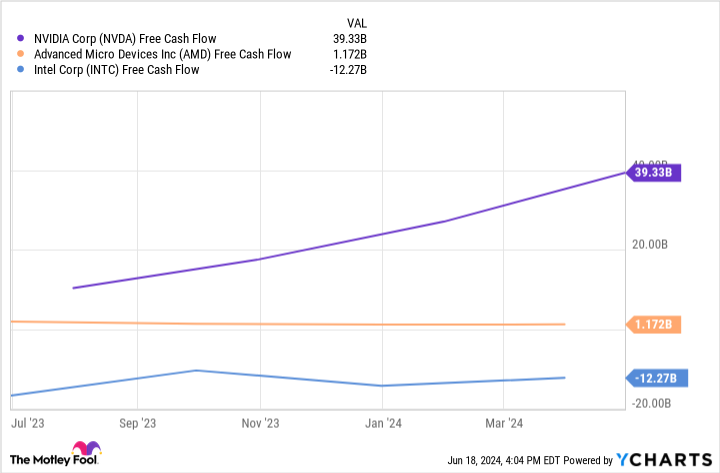

As the company has rocketed to stardom and proven how lucrative the business is, its competition wants a piece of that profit. The threat of an AMD or Intel catching up and eating into the roughly 80% market share Nvidia enjoys is real and should be taken seriously. However, Nvidia has major resources to defend itself through constant innovation.

In tech, having the best product goes a long way. AMD and Intel need to produce a product comparable to Nvidia’s if they hope to chip away at its market share. This takes money — a lot of it. AMD spent $1.5 billion in research and development (R&D) last quarter, while Nvidia spent $2.7 billion. Remember, Nvidia is already in pole position; it has the best tech on the market, and it’s still outspending AMD almost two to one.

Intel, on the other hand, is outspending both, at $4.4 billion last quarter. The…

..