Stock picking is going to get a bit more difficult in the near term, if the word coming out of Goldman Sachs is accurate. The firm’s strategist, Peter Oppenheimer, sees a combination of rising bond yields and high stock valuations working together to tighten up overall gains in the equity markets.

“The faster any rise in yields, the bigger the impact on equities,” Oppenheimer says, and adds, “Given the valuation of equities, it’s going to be a speed bump.”

But even with the stock rally looking at a possible shift to lateral movement, there are still paths forward. Oppenheimer notes, “Diversification is the opportunity that investors have in a flatter market environment.”

Diversification is a common strategy for a more careful approach to portfolio management, and while Oppenheimer is advocating that sort of caution, his colleagues among the Goldman stock analysts are busy selecting stocks where they see solid potential for gains.

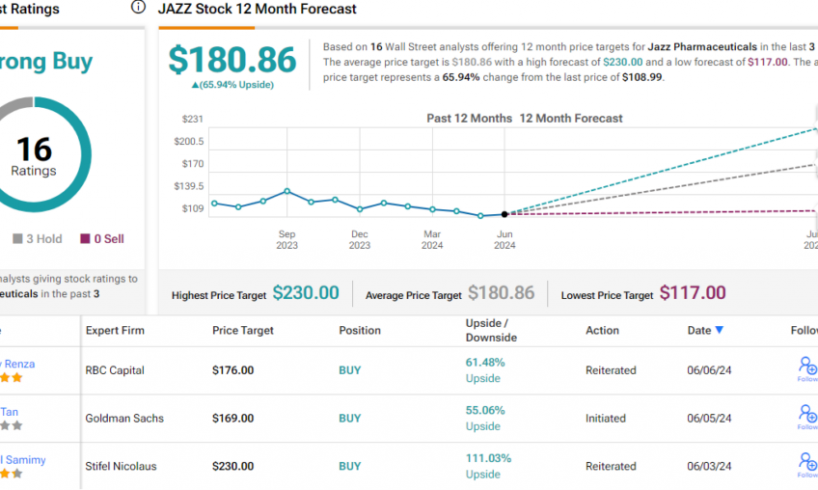

We ran two of their recent recommendations through the TipRanks database and it looks like the Street is in agreement with the Goldman view here – both are rated as Strong Buys by the analyst consensus. let’s see what sets them apart.

Jazz Pharmaceuticals (JAZZ)

For biotech firms, getting a medicine approved and on the market is akin to finding the Holy Grail – and Jazz Pharmaceuticals has a wide range of such approved products, in both the neuroscience and oncology fields. These commercialized medications ensure that Jazz, even though it also maintains an extensive pipeline of new drug research projects, runs a mostly consistent quarterly profit. From an investor’s perspective, this biotech offers a ‘best of both worlds’ situation, with a record of solid revenues and sales plus the high potential of promising drug candidates in the trial clinic.

Among the company’s existing and approved medications, three were named by the company as ‘key growth drivers’ in the first quarter of this year. These three showed a combined year-over-year revenue increase of 12%; two came from Jazz’s neuroscience portfolio, and…

..