Nvidia (NASDAQ: NVDA) has emerged as the dominant force in the AI data center chip industry. As big tech ramps up spending on new artificial intelligence (AI) models, Nvidia’s cutting-edge graphics processing units (GPUs) have been critical to their needs for rapid computational power.

Nvidia commands an estimated 80% of the AI chip market. As a result, its stock price has rocketed higher — joining the $1 trillion club last summer when it touched $3 trillion in market value on June 5. Among the few companies with market caps of $1 trillion or more, it’s the only one exclusively focused on semiconductors.

Yet, two other semiconductor companies benefiting from the current AI trend could soon join Nvidia in that upper echelon of mega-cap stocks. Helped by several growth drivers beyond AI, they could have a lot of staying power once they get into the $1 trillion club.

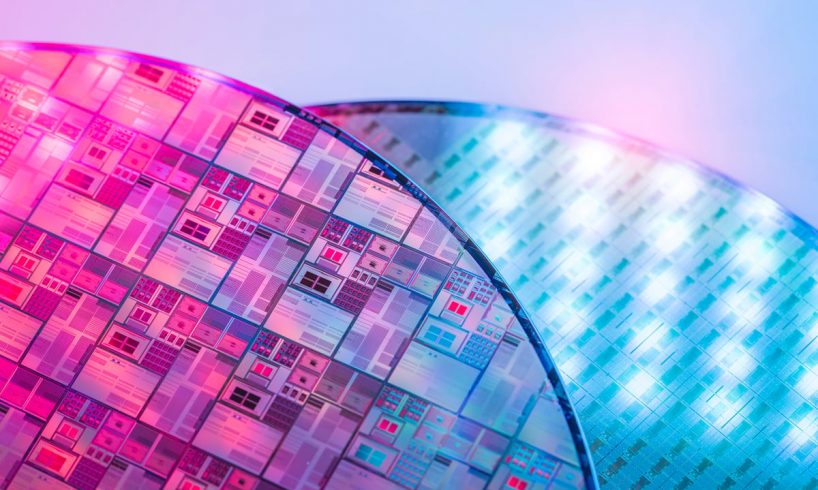

Image source: Getty Images.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC, is the largest semiconductor foundry in the world. Most semiconductor companies today don’t manufacture the chips they design. Companies like Nvidia contract out that process to fabrication specialists like TSMC.

TSMC takes on big capital expenditures and engineering R&D expenses to build out factories capable of printing ever-faster, more powerful, and more energy-efficient chips — and it makes more of them than anyone else. This has created a virtuous cycle: Because it offers leading-edge capabilities, it receives more business from chip designers. The profits those deals bring in allow it to reinvest more into the next generations of manufacturing processes.

Since TSMC’s processes can be applied to semiconductors for all sorts of applications, the foundry is not reliant on any specific case like artificial intelligence to support demand for its services. Instead, the never-ending march toward faster and more power-efficient computing drives demand for its manufacturing capacity.

That said, AI has certainly been a catalyst for TSMC recently. Management has forecast that its…

..