Advanced Micro Devices‘ (NASDAQ: AMD) artificial intelligence (AI)-fueled rally has come to a screeching halt in 2024. Shares of the chipmaker are down 29% since the beginning of March, when they were trading at a 52-week high, and the company’s latest results aren’t going to help arrest the slide.

AMD released first-quarter 2024 results on April 30, and investors pressed the panic button. Let’s see why that was the case.

Results were not strong enough to justify AMD’s expensive valuation

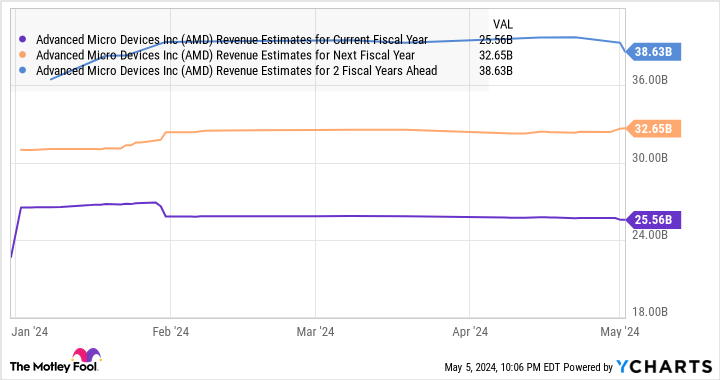

AMD reported Q1 revenue of $5.47 billion, an increase of just 2% from the year-ago period. The company’s non-GAAP earnings also increased at a tepid pace of just 3% year over year to $0.62 per share during the quarter. Analysts were looking for $0.62 per share in earnings on $5.48 billion in revenue, which means AMD barely met the bottom-line estimate and failed to satisfy the revenue expectation.

The guidance didn’t inspire much confidence either. AMD expects second-quarter revenue to land at $5.7 billion, which would be a year-over-year increase of just 6%. Though the Q2 revenue forecast points toward a slight acceleration in AMD’s growth, Wall Street was expecting slightly higher revenue of $5.73 billion.

For a stock that’s trading at an expensive 218 times trailing earnings, AMD needed to deliver much stronger growth to justify its rich multiple. The company managed to do that in two of its business segments, which are already reaping the benefits of the proliferation of AI, but weakness in the other two business segments weighed on its financial performance.

More specifically, AMD’s gaming revenue was down 48% year over year to $922 million. This steep decline was a result of poor demand for AMD’s semi-custom chips, which are deployed in gaming consoles from Microsoft and Sony, as well as weak sales of the company’s gaming graphics cards. The weakness in this segment isn’t surprising, as sales of personal computers (PCs), where gaming graphics cards are deployed, were weak last year.

Additionally, the video gaming market was flat last year. However, market research firm Newzoo…

..