Nvidia has dominated the AI narrative in the stock market, captivating investors and the media after soaring 2,190% over the past five years and becoming the most valuable company in the world for a brief period (it’s currently No. 2).

However, Nvidia is far from the only opportunity in the AI or semiconductor space. In fact, one chipmaker just reported 400%-plus year-over-year data center revenue growth and overall revenue growth of 84% to $8.7 billion in its latest earnings report (for the quarter ending Nov. 28).

I’m talking about Micron Technology (NASDAQ: MU), the memory-chip specialist that is surprisingly down 44% from its recent peak, despite that blowout growth. That discount and its potential in AI make the stock an appealing buy right now. Let’s review the company’s recent results first and then get into the buy case.

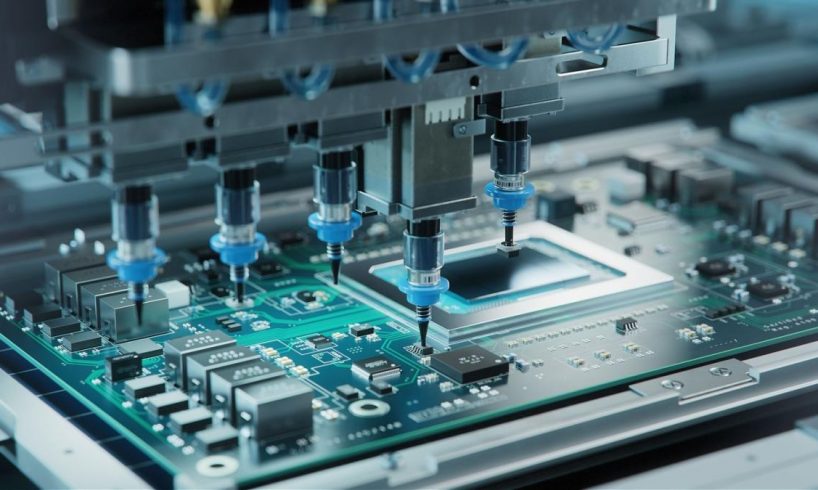

Image source: Getty Images.

Micron is a leader in memory chips, including DRAM, NAND, and high bandwidth memory (HBM). The company is also an integrated device manufacturer, meaning it both designs and manufactures its own chips like Intel and Samsung do.

Memory chips are a highly cyclical business, prone to price fluctuations and industry gluts, and owning its own foundries makes Micron more exposed to the boom and bust cycle in semiconductors. Running foundries requires a high level of capital, but the integrated business model allows the company to better capture margins when the business is performing well.

The chart below, which shows Micron’s price compared to its previous high, gives a sense of how volatile the stock has been. As you can see, over the last decade, the stock has fallen by 40% or more on four occasions before hitting a new all-time high.

Data by YCharts.

Cyclicality and volatility are part of the risk in investing in Micron, but there’s no question the semiconductor sector is in a boom right now, driven by the explosive growth of AI, though some subsectors like PCs and smartphones are weaker. In addition to Nvidia’s blowout growth, industry bellwether Taiwan Semiconductor Manufacturing recently…

..