“Don’t judge a book by its cover” is an old saying that should be heeded when considering high-yield dividend stocks. A great example is the nearly 15% yield on offer from AGNC Investment (NASDAQ: AGNC). It is, in fact, too good to be true if you need a reliable income stream. Most investors would probably be better off with Realty Income (NYSE: O) and its 5.6% yield.

There is nothing inherently wrong with AGNC Investment. The mortgage real estate investment trust (REIT) has done a fairly respectable job of generating total returns for its shareholders over time. But investing for total return is very different from investing for income.

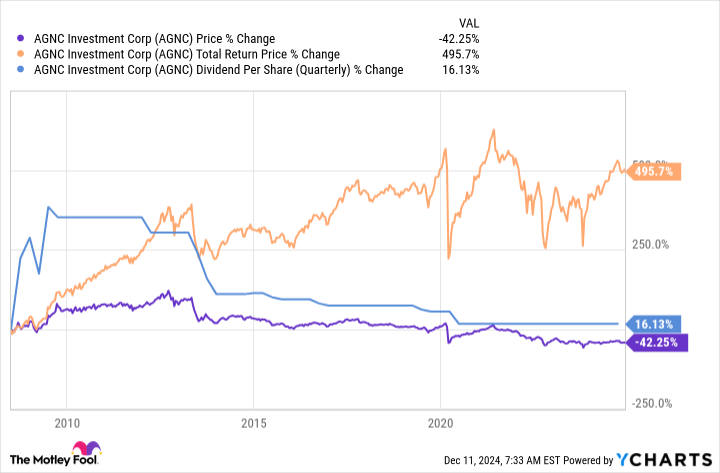

If you are investing for income, you probably want to collect and spend the dividends that a company distributes. If you are investing for total returns, you’ll need to reinvest the dividends to maximize your gains. That difference is important because AGNC Investment doesn’t behave like a traditional REIT that owns properties. Think of it more like an entity that invests in mortgage securities, which are fairly complex investment products. Just look at the graph below and you’ll see why spending the lofty income stream AGNC Investment has provided would have been a bad decision.

AGNC data by YCharts.

The blue line is the dividend, which rose sharply after the REIT’s IPO and then started to decline. The purple line is the stock price, which basically tracked the dividend. If you spent your dividends along the way, you would now be collecting less income and have a position that was worth less too. But the total return line has risen materially because the large dividends have more than made up for the falling share price as AGNC Investment has bought and sold mortgage securities over time. But you only got that return if you reinvested the dividends.

There is an argument to be made that the dividends collected over time have made up for the decline in the value of the shares, since the cumulative dividends plus the ending share price value would have left investors with roughly $30,000 on an initial $10,000…

..