(Bloomberg) — Asian stocks fell to the lowest level in almost two months on concerns US President-elect Donald Trump’s proposed tariffs and picks for key administration positions may stoke inflation.

Most Read from Bloomberg

Equity benchmarks in Japan and Australia retreated, with a regional gauge dropping to the weakest level since Sept. 19. The Bloomberg Dollar Spot Index was steady ahead of a report on US consumer-price inflation, while the yen approached the key level of 155.

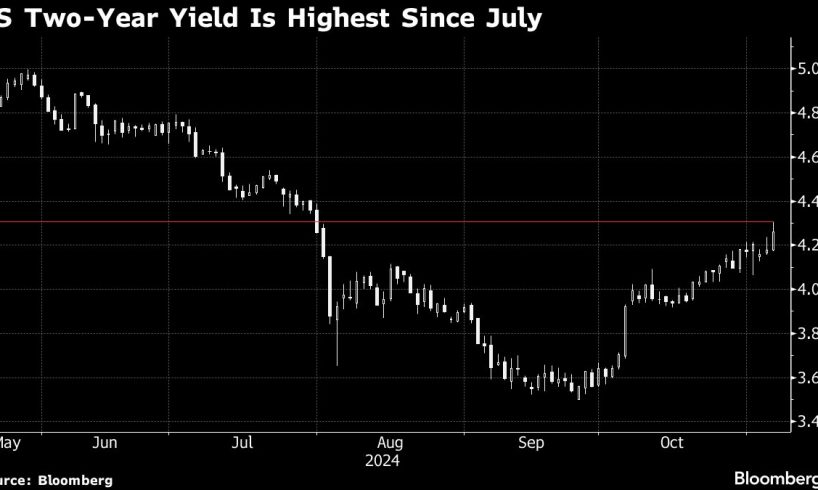

Treasury 10-year yields were little changed after surging 12 basis points on Tuesday. Traders are now pricing in about two US rate cuts through June, against almost four seen at the start of last week. US stock futures slipped.

Sentiment toward Asian equities has taken a cautious turn since Trump’s election, as traders expect his planned policies to further drive up inflation and slow the pace of interest-rate cuts. The president-elect’s picks for key government posts are also fueling jitters, as he stocks his Cabinet with people he wants to carry out his “America First” policies on the border, trade, national security and economy.

“While focus remains on Trump 2.0, there has been a slight tilt toward tariff fears which are overpowering the expectations of tax cuts given the announcements of China hawks being elevated to key positions in Trump’s cabinets,” said Charu Chanana, chief investment strategist at Saxo Markets.

Meanwhile, China indicated its discomfort with yuan weakness through its daily reference rate for the currency amid the threat of higher US tariffs under a Trump administration. The fixing was 445 pips stronger than the average estimate in a Bloomberg survey.

Beijing started marketing dollar bonds in Saudi Arabia, marking the country’s first debt sale in the US currency since 2021.

Traders are betting on further losses in Treasuries in anticipation that Trump’s planned policies will rekindle inflation and keep US interest rates high. Open interest, an indication of futures traders’ positioning in the bond market, rose for a fourth straight…

..