Cathie Wood is well known for her aggressive investing style. She’s poured billions of dollars into electric car manufacturers like Tesla and BYD, cryptocurrencies including Bitcoin, and dozens of other companies with massive upside potential — but with plenty of downside potential, too.

Right now, Wood’s hedge fund — ARK Innovation ETF — owns nearly 1.5 million shares of an incredible growth stock that most investors are clueless about. This up-and-coming fintech business could be her best idea yet.

This could be Cathie Wood’s best growth stock investment

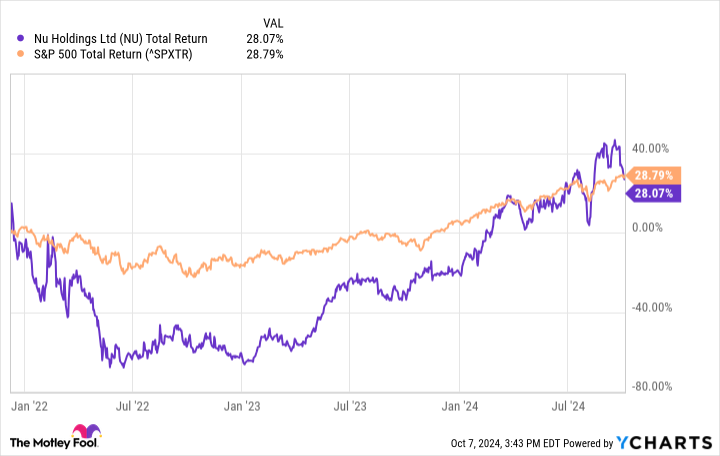

Cathie Wood’s fund has owned shares of Nu Holdings (NYSE: NU) since 2021 — the year the company went public. Since that time, Nu stock has been exceptionally volatile. In the 12 months following its IPO, Nu shares lost more than 70% of their value. But following a huge rebound, shares now trade above their original IPO price. How was Nu stock priced at $10 one year, $4 the next year, and then $13 the year after that? Clearly, the market has had a difficult time valuing this company. Even following the rebound, there’s reason to believe shares are still significantly underpriced.

Nu is a fintech stock focused on financial services in the Latin America region. It began operations roughly a decade ago, exclusively in Brazil. More recently, Nu expanded into Mexico and Colombia. The pitch was simple: Latin America’s banking sector was stuck in the Stone Age. A handful of powerful banks had been around for decades — or even centuries — and still offered basic services at high prices. The banks weren’t interested in shaking up the industry, but consumers were begging for an alternative. A decade later, it’s clear that Nu’s pitch was spot on. Before Nu jumped in, nearly the entire market was controlled by incumbent banks. Today, more than 50% of all Brazilian adults are Nu customers. And while that doesn’t translate exactly into 50% market share considering customers can have relationships with several banks at once, it does highlight a hefty appetite from the Brazilian market for banking alternatives..

What do…

..