Analog Devices (NASDAQ: ADI) isn’t as well-known in the semiconductor industry as major players like Nvidia or Taiwan Semiconductor, which are riding the fast-growing adoption of artificial intelligence (AI) and reporting eye-popping growth. That explains why shares of the chipmaker are up just 12% year to date, lagging the stunning gains recorded by some of its peers and the semiconductor sector overall.

However, a closer look at the company’s latest quarterly results and management’s commentary indicates the chipmaker is on the verge of a turnaround. With its offerings used in various end markets, including the industrial, automotive, consumer, and aerospace and defense industries, among others, buying this semiconductor stock right now could be a smart thing to do from a long-term perspective.

Analog Devices is struggling, but there are signs of a revival

Analog Devices released its fiscal 2024 third-quarter results (for the three months ended Aug. 3) last month. The company’s revenue fell 25% year over year to $2.31 billion, while non-GAAP earnings were down 37% from the same quarter last year to $1.58 per share.

The chipmaker’s poor year-over-year comparisons can be attributed to weak demand across almost all of its end markets. The industrial business, for example, is Analog’s largest segment and accounts for 46% of its top line. It witnessed a 37% year over year contraction in revenue. That’s not surprising as this segment is still reeling from the impact of the oversupply caused by poor demand last year.

More specifically, the global semiconductor industry’s revenue was down 11% in 2024 as demand remained weak for smartphones, personal computers, and data centers. Although AI has emerged as a savior for the semiconductor industry in the past year, Analog Devices hasn’t been able to ride this trend since it doesn’t make graphics processing units (GPUs) like Nvidia and AMD.

However, management points out that its performance in the previous quarter was better than expected, and the end markets it serves could soon start recovering.

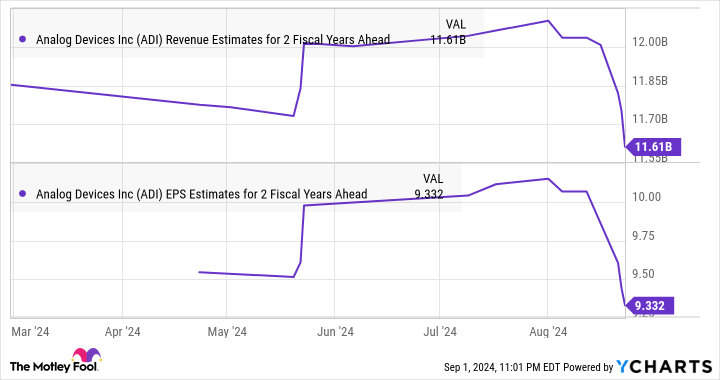

For guidance, Analog Devices…

..