(Bloomberg) — European stocks edged higher and US equity futures erased declines as investors assessed Nvidia Corp.’s results, ahead of key economic data still due this week.

Most Read from Bloomberg

The Stoxx Europe 600 index gained 0.3%, with technology stocks leading the advance. Futures on the Nasdaq 100 Index were down 0.1% after the gauge fell more than 1% on Wednesday. S&P 500 contracts were little changed. Nvidia slumped more than 8% in post-market trading.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

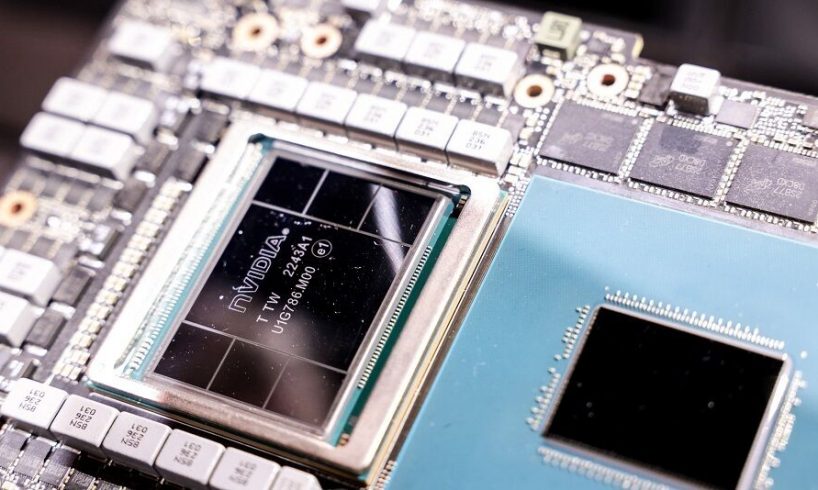

Nvidia’s underwhelming sales forecast threatens to cool the AI frenzy that has powered global tech stocks for much of this year. But while the guidance underwhelmed, revenue more than doubled to $30 billion in the fiscal second quarter, suggesting demand remains strong.

With the earnings season now officially over, the focus turns back to the macro landscape. The Federal Reserve’s preferred inflation gauge, due Thursday, may help firm up bets on how much and how quickly the central bank will ease policy.

“One should not forget that all semi companies are not exposed to the AI trend as Nvidia, and some have large exposure to handset, auto or industrials,” said Gaël Combes, head of equities at Banque Syz & Co. “An economic slowdown is a risk.”

Treasury 10-year yields steadied after rising one basis point to 3.84% in the previous session. The dollar edged lower after gaining broadly amid speculation investors were buying the US currency for portfolio re-balancing.

Investors are weighing US interest rate cut prospects as Fed Bank of Atlanta President Raphael Bostic said it “may be time to cut” but he’s still looking for additional data to support lowering interest rates next month.

In commodities, oil steadied after a two-day drop, with stock market losses offsetting a drawdown in US stockpiles and supply disruptions in Libya. Gold traded just below its record high, on course for a monthly gain.

Key events this week:

Eurozone consumer confidence, Thursday

US GDP, initial jobless claims, Thursday

Fed’s…

..