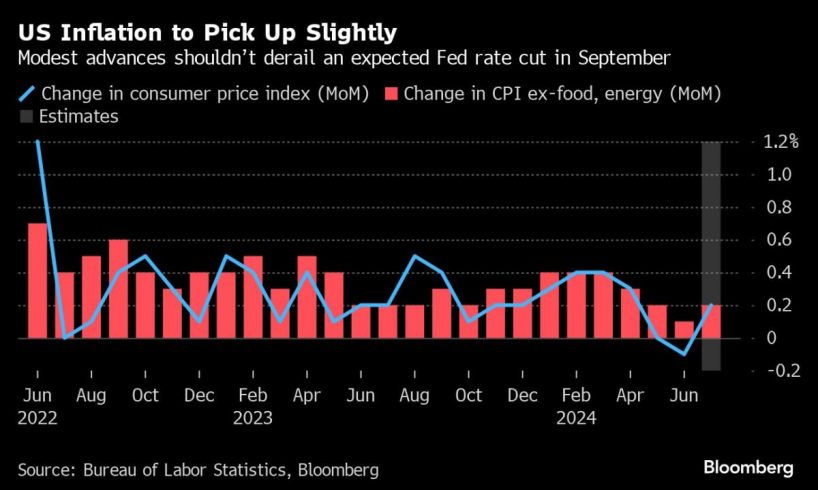

(Bloomberg) — Stocks rallied and bond yields fell after the latest US inflation reading reinforced speculation the Federal Reserve will be able to deploy its widely anticipated interest-rate cut in September.

Most Read from Bloomberg

Just 24 hours ahead of the consumer inflation report, data showed the producer price index rose less than forecast. Categories in the PPI report used to calculate the Fed’s preferred inflation measure — the personal consumption expenditures price index — were generally tame. The S&P 500 climbed 1.7%, led by gains in the world’s largest technology companies. Treasuries rose across the curve, with the move driven by shorter maturities. The dollar fell.

“Markets searching for stability got more evidence of cooling inflation,” said Chris Larkin at E*Trade from Morgan Stanley. “The lower-than-expected reading will probably be welcomed by a stock market attempting to bounce from its biggest pullback of the year.”

The easing of price pressures has bolstered confidence US officials can start lowering borrowing costs while refocusing on the labor market, which is showing greater signs of slowing. Fed Bank of Atlanta President Raphael Bostic said he’s looking for “a little more data” before supporting a reduction in rates, while reiterating he’ll likely be ready to cut “by the end of the year.”

To Ian Lyngen at BMO Capital Markets, there isn’t anything in Tuesday’s data suggesting the Fed will have any hesitation cutting rates next month.

“That said, tomorrow’s consumer inflation update is far more relevant to near-term policy expectations,” he noted.

A survey conducted by 22V Research showed 52% of investors expect the reaction to Wednesday’s consumer price index to be “risk-on.” However, the percentage of respondents expecting a “recession” has stayed elevated.

The S&P 500 saw its biggest four-day rally this year. The Nasdaq 100 climbed 2.5%. The Russell 2000 rose 1.6%. Starbucks Corp. surged 25% after ousting its chief and picking Chipotle Mexican Grill Inc.’s Brian Niccol as its next leader. In…

..