There are two big schools of thought in investing. In one school, investors focus on growth, buying businesses they hope are much larger five, 10, or 20 years in the future. In the other school, investors search for yield, buying dividend-paying stocks to build passive income and a reliable cash-flow stream for their portfolios. Of course, there are more than just these two considerations when buying stocks, but growth and yield are two of the main factors.

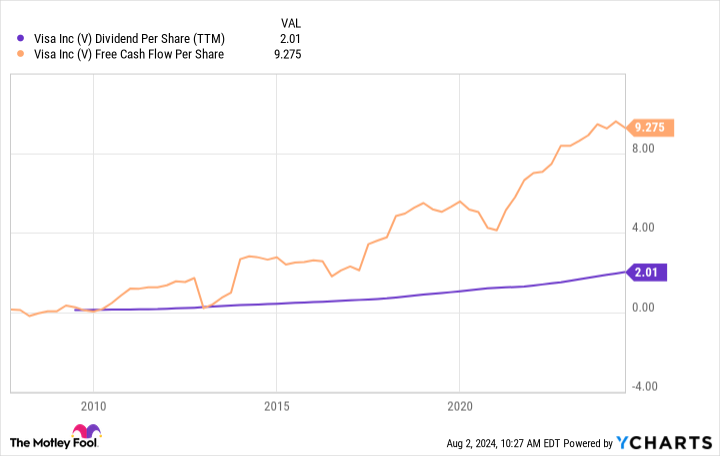

Dividend-growth investing combines the best of both worlds. Dividend-growth stocks are ones that not only make regular cash payments to investors but also have a growing business that can fuel dividend growth over the long haul. The perfect dividend-growth stock might be Visa (NYSE: V), the global payments giant.

Today, you can buy shares for a 10% discount from the stock’s all-time highs set earlier this year. Here’s why now may be the time to buy the dip on Visa stock.

Visa: A take rate on global spending

Visa is a company most of you will know. It is the world’s largest credit card, debit card, and payments network, serving 4.5 billion credit/debit cards as of last quarter. That is up from 4.2 billion in the same quarter a year ago. A huge percentage of the world’s consumer spending runs on the Visa network, from the United States to Europe to emerging markets in Asia and Africa.

The business model works slightly differently than you might imagine. Even though Visa is the brand on a ton of cards, it’s not actually a bank or credit issuer. Banking partners such as Bank of America or JPMorgan Chase are the ones taking credit risk. Visa makes money by taking a cut of every transaction spent on its network, which it then splits up and shares with its banking partners.

Visa’s business is effectively a take rate on global economic growth. First, as global consumer spending grows, Visa’s payment volume grows. Second, Visa benefits from the global transition of cash payments to cashless digital transactions. These are two simple tailwinds that have been in place for multiple decades and should continue in the coming…

..