(Bloomberg) — Japan equities are set to regain some ground after suffering the biggest hit in Monday’s global rout, which wiped out billions across markets from New York to London. US equity futures climbed in early trading.

Most Read from Bloomberg

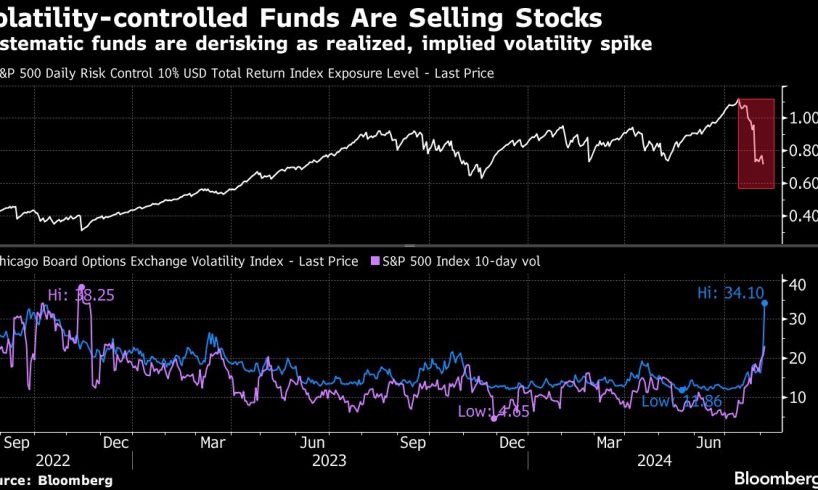

Futures show the Nikkei 225 gaining more than 6% when it reopens Tuesday, following a 12% slump that was the worst one-day decline in yen terms. Hong Kong and Sydney shares look more steady, suggesting traders may be ready to catch their breath following a dramatic day in which Wall Street’s “fear gauge” – the VIX – at one point registered its largest spike in data going back to 1990.

While the S&P 500 pared some of its losses to finish 3% lower Monday, it still suffered the biggest plunge in about two years amid strong trading volume. The tech-heavy Nasdaq 100 saw its worst start to a month since 2008. Still, futures show both those indices may gain when US trading begins later Tuesday.

Speculation about a looming US recession — mostly seen as premature — wiped out a celebratory mood driven by recent signals from the Federal Reserve about the timing of its first rate cut. The repricing was so sharp that the swap market earlier assigned a 60% chance of an emergency rate reduction by the Fed over the coming week. Those odds subsequently ebbed.

“The economy is not in crisis, at least not yet,” said Callie Cox at Ritholtz Wealth Management. “But it’s fair to say we’re in the danger zone. The Fed is in danger of losing the plot here if they don’t better acknowledge cracks in the job market. Nothing is broken yet, but it’s breaking and the Fed risks slipping behind the curve.”

Treasuries lost some steam after a surge that briefly drove two-year yields — which are sensitive to monetary policy — below those on 10-year bonds. US 10-year yields were little changed at 3.78%. The dollar fell. A gauge of perceived risk in the US corporate credit markets soared, with the turmoil effectively shutting down bond sales on what had been expected to be among the busiest days of the year. Bitcoin sank about…

..