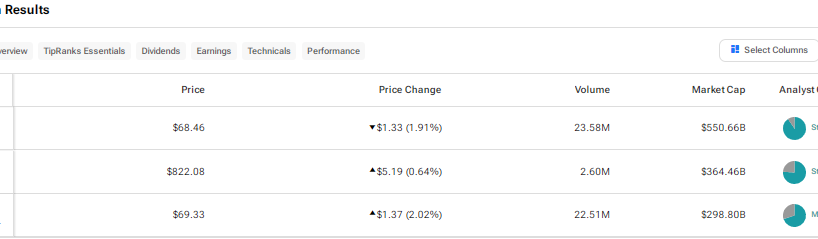

Consumer staples companies generally tend to be resilient during challenging macroeconomic times. This is because they sell products that are considered essential for daily life. Using TipRanks’ Stock Comparison Tool, we placed Walmart (WMT), Costco (COST), and Coca-Cola (KO) against each other to find the best consumer staples stock, according to Wall Street analysts.

Walmart (NYSE:WMT)

Shares of big-box retailer Walmart have rallied about 30% so far this year. WMT impressed investors with its upbeat results for Q1 FY25 (ended April 30, 2024). The 22% growth in Q1 FY25 adjusted earnings per share (EPS) was driven by strong revenue growth, higher gross margin, and membership income.

Walmart’s value offerings continue to attract bargain-seeking customers amid a tough macro backdrop. The company’s grocery business is witnessing strong growth, with many customers preferring to cook at home than dine out at restaurants due to high inflation.

WMT is also gaining from the strength in its e-commerce business. In Q1 FY25, WMT’s e-commerce sales increased 21%, fueled by store-fulfilled pickup and delivery and the company’s growing marketplace. Importantly, the company is trying to enhance its profitability by focusing on high-margin businesses like advertising, membership, marketplace and fulfillment solutions, and data analytics and insights.

Walmart is scheduled to announce its fiscal second-quarter results on August 15. Analysts expect the company’s EPS to increase by 6.5% to $0.65 per share and revenue to grow over 4% to $167.4 billion.

Is Walmart a Good Stock to Buy Now?

Last week, BMO Capital analyst Kelly Bania raised the price target for WMT stock to $80 from $75 and reaffirmed a Buy rating following meetings with the company’s management. The analyst stated that Walmart is well-positioned to increase its EBIT (earnings before interest and taxes) at a faster rate than sales, even as the company continues to make growth investments.

The analyst thinks that management’s expectation of the U.S. e-commerce operations turning profitable in the next one to…

..