Apple is the most valuable company in the world right now with a market capitalization of $3.4 trillion, but it’s closely followed by two other tech giants, Microsoft (NASDAQ: MSFT) and Nvidia (NASDAQ: NVDA). It’s worth noting that both Microsoft and Nvidia have taken turns becoming the world’s most valuable company this year, but Apple has managed to regain the top spot, thanks to a recent surge in the stock price.

However, if we compare Apple’s prospects to those of Nvidia and Microsoft for the next five years, it won’t be surprising to see them becoming more valuable than the iPhone maker. Below is a look at the reasons why.

1. Microsoft

Microsoft’s market cap of $3.3 trillion means that it’s strikingly close to Apple right now. More importantly, Microsoft is clocking faster growth than Apple, a trend that’s likely to continue over the next five years, thanks to the growing adoption of artificial intelligence (AI) in multiple markets.

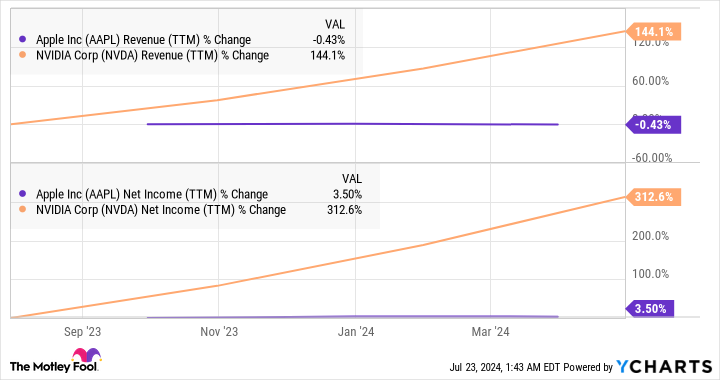

For instance, Microsoft’s revenue in the third quarter of fiscal 2024 (which ended on March 31) increased 17% year over year to $61.9 billion. Meanwhile, Apple’s fiscal 2024 second-quarter revenue (for the three months ended March 30) was down 4% year over year to $90.8 billion. This stark difference in the performance of the two tech giants is largely due to AI.

While Microsoft is capitalizing on multiple AI-driven growth trends such as cloud computing, personal computers (PCs), and workplace collaboration tools, Apple has been late to the AI smartphone market. Microsoft’s Intelligent Cloud segment reported a 21% year-over-year increase in revenue in fiscal Q3 to $26.7 billion, driven by the growing usage of its cloud-based AI services.

The company pointed out that its Azure cloud business received a boost of 7 percentage points, thanks to AI. The cloud-based AI services market is forecast to generate $647 billion in revenue in 2030, clocking a compound annual growth rate of nearly 40% through the end of the decade, and Microsoft is sitting on a potentially large incremental revenue opportunity in this market.

Also, Microsoft…

..