In this piece, I evaluated two artificial intelligence (AI) stocks, SoundHound AI (SOUN) and C3.ai (AI), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of SoundHound and a bearish view of C3.ai.

SoundHound AI provides conversational intelligence via its independent voice-AI platform, which enables businesses to provide conversational experiences to their customers. Meanwhile, C3.ai is an enterprise AI company that provides software-as-a-service applications enabling customers to develop, deploy, and operate large-scale enterprise AI applications across infrastructures.

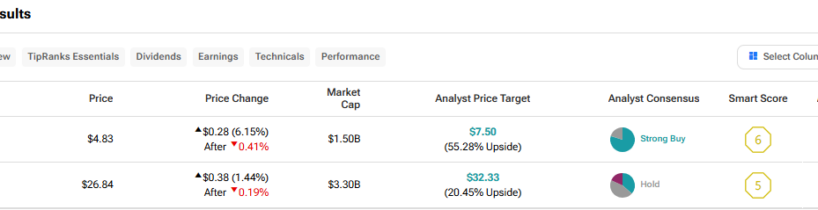

SoundHound AI stock has surged 128% year-to-date, bringing its 12-month return into the green at 97%. On the other hand, C3.ai shares are off 6.5% year-to-date and have tumbled 35% over the last year.

With such a dramatic difference in their share-price performances year-to-date, the sizable gap between their valuations is no surprise. Since neither company is profitable, we’ll use their price-to-sales (P/S) ratios to gauge their valuations against each other.

We can also compare them to the broader application software industry, which is trading at a P/S of 8.7x, in line with its three-year average.

SoundHound AI (NASDAQ:SOUN)

At a P/S of 32x, SoundHound AI is certainly not cheap, trading at a sizable premium to the application software industry, although the fact that it’s an AI stock suggests some premium is warranted. However, based on this valuation and other factors, a neutral view seems appropriate.

First, SoundHound AI is not profitable, which should give investors pause, especially with a market capitalization of $4.5 billion. The company’s net income margins aren’t very encouraging either, standing at -186% for the last 12 months and -194% for 2023. While they’re trending in the right direction each year, caution seems warranted for now.

What’s particularly worrisome is that the company projected profitability in 2023 but came up short, posting a net loss of $88.9 million and an adjusted loss of 40 cents per share for the year.

In…

..