Stock splits are back in the spotlight after Nvidia took this step recently. Investors should remember that this is simply a cosmetic move that doesn’t change the value and fundamentals of a company. What a stock split does is increase the number of outstanding shares while reducing the price of each share. So, the overall market value of the company remains the same.

However, there is a belief that a stock split might increase demand for a company’s shares because more investors would be able to buy them, with each share now available at a lower price.

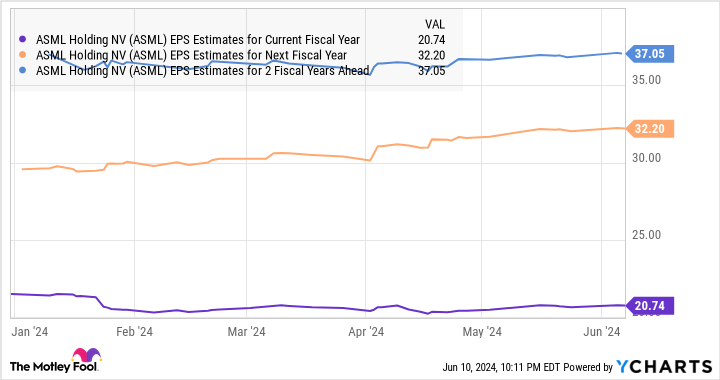

That’s probably one reason why the likes of Super Micro Computer (NASDAQ: SMCI) and ASML Holding (NASDAQ: ASML) could consider splitting their shares. Let’s check why these two companies, which are playing a crucial role in the artificial intelligence (AI) revolution, look ripe for a stock split.

1. Super Micro Computer

The stock of Super Micro Computer (also known as Supermicro) has tripled in value over the past year and is now worth just over $760 a share. However, it’s still down 34% from the 52-week high that it hit in March, which is why management might consider splitting the stock to attract investor interest.

Supermicro has never executed a stock split. Management probably didn’t feel the need to do so because shares were trading at around $80 at the end of 2022. However, the booming demand for its AI server solutions has led to an 858% increase in its share price since the beginning of 2023. That means Supermicro has jumped by a multiple of more than 9 in less than 18 months.

That’s why the time looks ripe for a stock split at Supermicro. However, because a split is nothing more than a cosmetic move, now would be a good time to buy its shares regardless of a split to take advantage of the recent pullback in the stock’s price.

After all, the demand for Supermicro’s AI servers is so strong that its revenue tripled in the third quarter of its fiscal 2024 (which ended on March 31) to $3.85 billion, and adjusted net income quadrupled year over year to $6.65 per share.

Management has guided for fiscal…

..