(Bloomberg) — Asian stocks are set to gain in early trading, following US peers on Friday, as expectations for Federal Reserve rate cuts were bolstered after the central bank’s preferred measure for inflation eased.

Most Read from Bloomberg

Equity futures in Australia, Japan and Hong Kong point to higher opens on Monday. US contracts were little changed after the S&P 500 rose 0.8% in its previous session, following a late surge amid a rotation from technology stocks to other industries.

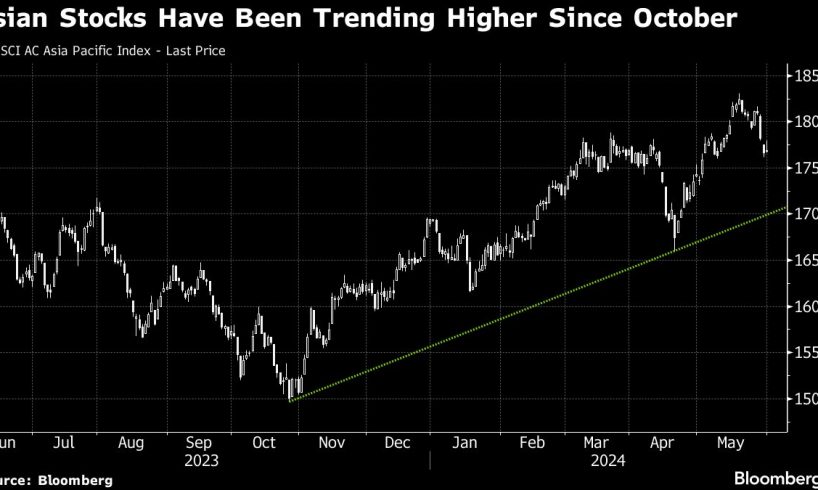

The gain follows the best month for Asian stocks since March last month, aided by signs of stabilization in China’s economy and a weaker dollar amid bets the Fed can cut interest rates this year. But with valuations appearing stretched, markets are likely to be volatile as traders assess the outlook for central bank policy, while geopolitical tensions surrounding the Middle East and the US election simmer, according to AMP Ltd.

“We continue to see further gains in shares this year as disinflation continues, central banks ultimately cut interest rates and recession is avoided or proves mild,” said Shane Oliver, chief economist and head of investment strategy at AMP in Sydney. “But the risks of a deeper correction beyond that seen in April have increased.”

Oil slipped in early trading after OPEC+ extended its production cuts in efforts to bolster a fragile market. While the deal exceeded market expectations, it also rolls back those supply reductions in October, earlier than some OPEC-watchers had assumed.

Elsewhere, elections in India and Mexico are likely to set the tone in emerging markets. Indian stocks, bonds and the rupee are poised to climb on Monday after exit polls indicated a resounding victory for Prime Minister Narendra Modi’s party, while the Mexican peso was quoted higher in early trading with the polls still open.

Follow Bloomberg’s Mexico election live blog here for the latest results

The dollar was steady in early trading. US Treasuries rose Friday as the Fed’s preferred measure of inflation, the core personal consumption expenditures price gauge, met…

..