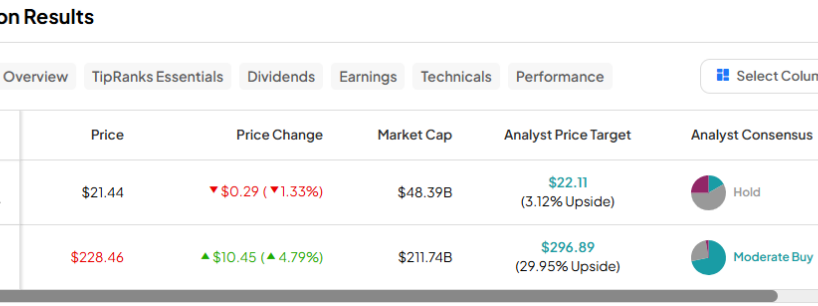

In this piece, I evaluated two software stocks, Palantir Technologies (NYSE:PLTR) and Salesforce (NYSE:CRM), using TipRanks’ Comparison Tool to see which is better. A closer look suggests a neutral view of Palantir Technologies and a bullish view of Salesforce.

While both companies develop software, Palantir Technologies specializes in big-data analytics, while Salesforce focuses on customer relationship management (CRM). Shares of Palantir Technologies are up 25% year-to-date and have soared 48% over the last year. Meanwhile, Salesforce stock is down 14% year-to-date, although it has gained 6.5% over the past year.

With such a dramatic difference in their share price performances, the significant gap in their valuations is no surprise. Below, we’ll compare their price-to-earnings (P/E) ratios to gauge their valuations against each other and that of their industry.

For comparison, the software industry is trading at a P/E of 50.7x versus its three-year average of 61.5x.

Palantir Technologies (NYSE:PLTR)

At a GAAP P/E of 165.4x, Palantir Technologies is trading at a significant premium to its industry and to Salesforce. While there is much to like about the company and its exposure to artificial intelligence, its valuation has simply gotten too high. Thus, a neutral view seems appropriate, pending a more attractive entry price.

Importantly, 2023 was Palantir’s first GAAP-profitable year, meaning it was profitable based on generally accepted accounting principles and thus needed no adjustments to make it look profitable. The company has benefited greatly from its association with artificial intelligence, given that any company with a distant interest in AI has seen its stock explode over the last year or two.

While Palantir likely has a long life ahead, its valuation has just gotten too far ahead of itself. As a result, it only takes a single questionable metric within its financial results to spark a sell-off — making stocks like Palantir extremely risky because it’s virtually impossible to predict what small detail might trigger a sell-off. However, even…

..