Now that we’ve had time to digest the April jobs numbers, some strategists are getting worried about the economy’s mid-term outlook. The jobs report showed 175,000 new jobs added in the month – but that was the lowest gain in the past six months, and was accompanied by an uptick in unemployment, from 3.8% to 3.9%. Along with these topline numbers, the report showed declines in job openings and hires.

For Roukaya Ibrahim, watching the US economy from BCA, this job report may indicate a shift toward a recession by the end of this year or early in 2025.

“I think that there’s still a runway for the soft landing narrative to continue over the coming months. But eventually, the unemployment rate is going to take higher and that’s going to lead to concerns about a recession,” Ibrahim noted.

The strategist goes on to predict that, in the event of a recession, the S&P 500 could drop to 3,600, or a 31% decline from current levels.

That may be a gloomy outlook, and it suggests a defensive stance for investors – which will naturally turn our attention to dividend stocks. These shares are known for providing real protection to an investment portfolio during a downturn, through a reliable income stream via dividend payments.

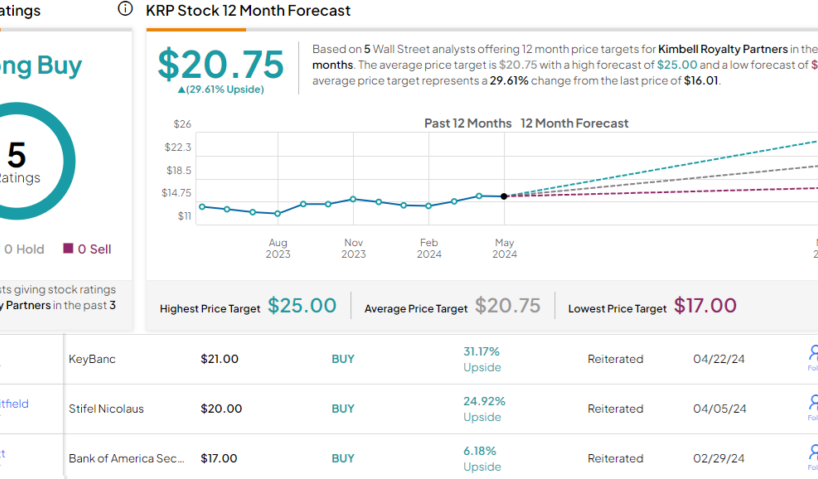

Against this backdrop, some Wall Street analysts have given the thumbs-up to two dividend stocks yielding more than 12%. Opening up the TipRanks database, we examined the details behind these two to find out what else makes them compelling buys.

Kimbell Royalty Partners (KRP)

For the first stock on our list, we’ll head to Fort Worth, Texas, where Kimbell Royalty Partners has its headquarters. This company has chosen the right place to set up shop – Texas, in recent decades, has become a major player in the world energy industry, and Kimbell is in the mineral rights business. The company buys land titles and associated mineral rights in rich hydrocarbon basins across the US, and earns royalties on the oil and gas production that takes place on its holdings. The company currently holds approximately 17 million gross acres in 28 states, with…

..