Earnings season is in full swing, and all eyes are on the “Magnificent Seven” stocks. Apple (NASDAQ: AAPL) just hit the earnings tape with one major headline: a $110 billion stock buyback authorization. This is a notable announcement, as it marks the largest share buyback in U.S. corporate history.

Let’s break down why stock buybacks are important, and analyze some of the other themes of Apple’s earnings. After a thorough review of the report, you may want to think twice before scooping up shares of the iPhone maker.

Stock buybacks are great

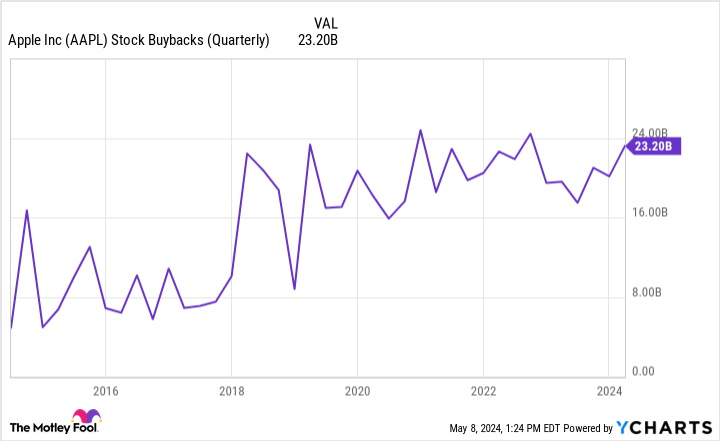

The chart below illustrates Apple’s stock buyback history over the last 10 years. Clearly, the company has done a stellar job returning capital to investors through a series of consistent stock buybacks:

AAPL Stock Buybacks (Quarterly) Chart

One of the biggest reasons a company may purchase its own shares is because management views the stock as undervalued.

A more subtle reason why a company may repurchase stock is to increase earnings per share (EPS). This is where one of my suspicions and concerns comes into play.

Image source: Getty Images.

But where is Apple’s real growth coming from?

Below is a summary of Apple’s annual revenue growth over the last several quarters:

Quarter ended Dec. 31, 2022: negative 5%

Quarter ended April 1, 2023: negative 3%

Quarter ended July 1, 2023: negative 1%

Quarter ended Sept. 30, 2023: negative 1%

Quarter ended Dec. 30, 2023: 2%

Quarter ended March 30, 2024: negative 4%

For more than a year, Apple has consistently experienced a year-over-year revenue drop — with the lone exception being the holiday season at the end of last year.

While a challenging macroeconomic picture with lingering inflation and rising borrowing costs is playing some role in Apple’s struggles, there are deeper issues at hand. Specifically, Apple’s business in China — one of its biggest markets — is decelerating.

For the period ended March 30, Apple’s revenue in China dropped 8% year over year to $16.4 billion. Much of this was attributable to a stalling iPhone segment, which dropped 10% year over year to $45.9 billion in all…

..